Friday, September 29, 2006

Daily Report September 29th Friday

Nifty (3571) SUPPORT-3559-3536-3511 RESISTANCE-3592-3628-3674 Nifty should cross 3592 to be bullish, Nifty & Sensex is not behaving in tandem it can be F&O or else ONGC effect as nifty closed negative while sensex positive so it makes it simple to have alternate view. Now stop loss for nifty target 3856 would be 3508 on closing basis & before I had mentioned target for month end SEP2006 as 3650 and 3604 has been seen market is correct we will see wat it says.TOP 5GAINERS=ORIENTBANK-NATIONALUM-PNB-HDFC-HDFCBANK TOP5LOSER=LT-HINDPETRO-JETAIRWAYS-DRREDDY-TCS. P/E=20.83 p/b=4.73 adv=15 dec=35 NSE adv: 491 dec: 429 -vol-rs.8598crs

Sensex (12380) SUPPORT-12328-12234-12117 RESISTANCE-12464-12546-12624 Sensex has formed almost double bottom near the gap at 12339 which will be support now it would be wise to jus ride the wave till we get a clear reversal signal as today close will be significant in many ways month end close previous high 12042 and weekly highest close 12359 & on a daily basis 12624 and highest 12671 so we are very close to many all time highs and each and every thing has big impact in markets sentiment and important would be will we make all in one go.

8dma=12229 13dma=12110 21dma=11999 34dma=11807 55dma=11362 OPEN=12388 HIGH=12431 LOW=121340 BSE adv: 1355 dec: 1134 -vol-rs.3948crs

Fiis buyer rs.555crs & Mutual funds seller rs.115 on Wednesday, Fiis buyer rs.4705crs in Sep month and buyer rs.22094Crs in 2006, mutual fund buyer rs.909crs in Sep month. F&O DATA Fiis sell rs.556crs in nifty future and sell rs.313crs in stock future on 28th September and provisional Fiis buy in cash rs.228crs source NSE website

Day That Ended: Last day of F&O surprise was less than 1% movement intraday in the index and FIIs data say there OI in F&O is rs.18930crs which hasn’t grown much after MAY2006 crash while they have invested nearly rs.4700crs in this month alone till now. BANKEX gained 3.7% and that index has broken all time high on Wednesday itself this is 2nd performing sectoral index after TECH & AUTO should be catching up soon followed by HC-CD in my view. International markets U.S markets closed positive with Indian ADRs where down EURO markets positive ASIAN markets positive now CRUDE $ 62.44.

Outlook for Friday: Month end closing quarterly, half yearly weekly so all mixed together gives this day closing so much of importance and we today see few significant all time records created, panic would be chance to add as DOWJONES is almost near to its 2000 high till now it has been on Indian market strength we have gone up now soon we would see global markets rally. Result season buying with euphoria, rumour & speculation would start and SEP11 is INFOSYS results, I would remind investors that if u have invested in 10 stocks 2can be wrong and this happen with MF-FIIs when BANKS lend they have NPA so chances of error is high so divide u r risk sector wise & stock wise and if u r capital is too small and if u feel it wont be possible best option would be mutual funds.

HOTSTOCKS: EIDPARRY-TATACHEM-M&M-STER-

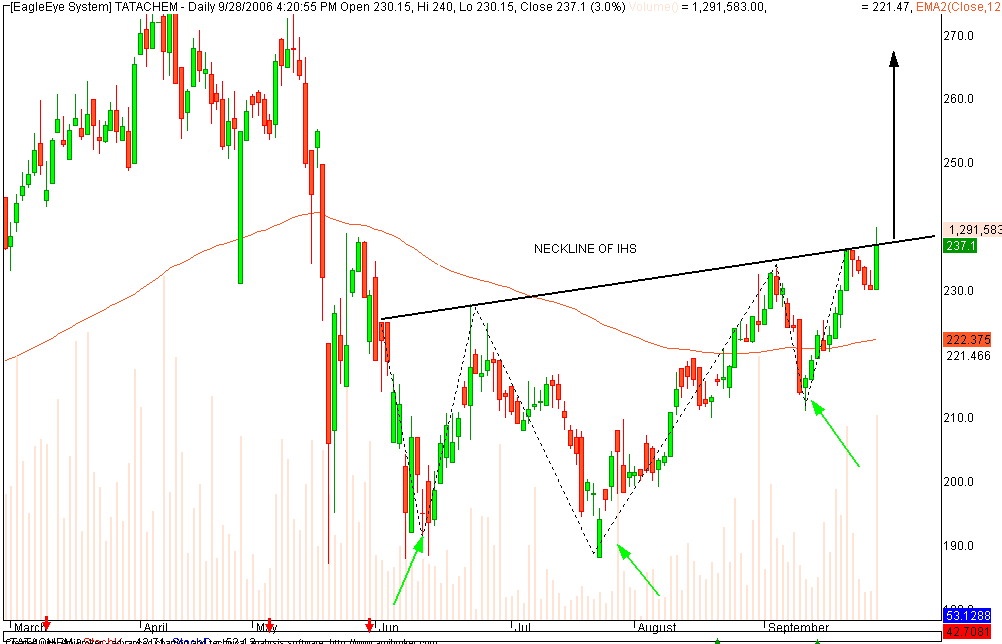

BREAKOUT stocks: http://prabhakar-views.blogspot.com TATACHEM(238): 10-12% upside above rs.240 & this should happen at a very fast pace. The stock has closed at high after MAY17 2006, looks good on monthly, weekly, daily and now hourly charts also.

http://in.groups.yahoo.com/group/prabhakar-views/join

Disclaimer: These recommendations are based on the theory of technical analysis and personal observations. This does not claim for profit. I am not responsible for any losses made by traders. It is only the outlook of the market with reference to its previous performance. You are advised to take your position with your sense and judgment. I am trying to consider the fundamental validity of stocks as far as possible, but demand and supply affects it with vision variations.

http://www.marketwatch.com/news/story/Story.aspx?guid=%7B93C12C7C%2D8611%2D4394%2D8C94%2DF4571CCA31F5%7D&siteid DOWJONES high of 11,722.98 -- set on Jan. 14, 2000 -- in the past week, and its record intraday high of 11,750.28

http://www.businessstandard.com/common/storypage_c.php?leftnm=10&bKeyFlag=BO&autono=260092&chkFlg M&M buys 68% in Germany`s Jeco

http://www.businessstandard.com/common/storypage_c.php?leftnm=10&bKeyFlag=BO&autono=260093&chkFlg Wipro arm to buy Swedish firm.

http://content.icicidirect.com/market/BoardMeetings.asp

Sensex (12380) SUPPORT-12328-12234-12117 RESISTANCE-12464-12546-12624 Sensex has formed almost double bottom near the gap at 12339 which will be support now it would be wise to jus ride the wave till we get a clear reversal signal as today close will be significant in many ways month end close previous high 12042 and weekly highest close 12359 & on a daily basis 12624 and highest 12671 so we are very close to many all time highs and each and every thing has big impact in markets sentiment and important would be will we make all in one go.

8dma=12229 13dma=12110 21dma=11999 34dma=11807 55dma=11362 OPEN=12388 HIGH=12431 LOW=121340 BSE adv: 1355 dec: 1134 -vol-rs.3948crs

Fiis buyer rs.555crs & Mutual funds seller rs.115 on Wednesday, Fiis buyer rs.4705crs in Sep month and buyer rs.22094Crs in 2006, mutual fund buyer rs.909crs in Sep month. F&O DATA Fiis sell rs.556crs in nifty future and sell rs.313crs in stock future on 28th September and provisional Fiis buy in cash rs.228crs source NSE website

Day That Ended: Last day of F&O surprise was less than 1% movement intraday in the index and FIIs data say there OI in F&O is rs.18930crs which hasn’t grown much after MAY2006 crash while they have invested nearly rs.4700crs in this month alone till now. BANKEX gained 3.7% and that index has broken all time high on Wednesday itself this is 2nd performing sectoral index after TECH & AUTO should be catching up soon followed by HC-CD in my view. International markets U.S markets closed positive with Indian ADRs where down EURO markets positive ASIAN markets positive now CRUDE $ 62.44.

Outlook for Friday: Month end closing quarterly, half yearly weekly so all mixed together gives this day closing so much of importance and we today see few significant all time records created, panic would be chance to add as DOWJONES is almost near to its 2000 high till now it has been on Indian market strength we have gone up now soon we would see global markets rally. Result season buying with euphoria, rumour & speculation would start and SEP11 is INFOSYS results, I would remind investors that if u have invested in 10 stocks 2can be wrong and this happen with MF-FIIs when BANKS lend they have NPA so chances of error is high so divide u r risk sector wise & stock wise and if u r capital is too small and if u feel it wont be possible best option would be mutual funds.

HOTSTOCKS: EIDPARRY-TATACHEM-M&M-STER-

BREAKOUT stocks: http://prabhakar-views.blogspot.com TATACHEM(238): 10-12% upside above rs.240 & this should happen at a very fast pace. The stock has closed at high after MAY17 2006, looks good on monthly, weekly, daily and now hourly charts also.

http://in.groups.yahoo.com/group/prabhakar-views/join

Disclaimer: These recommendations are based on the theory of technical analysis and personal observations. This does not claim for profit. I am not responsible for any losses made by traders. It is only the outlook of the market with reference to its previous performance. You are advised to take your position with your sense and judgment. I am trying to consider the fundamental validity of stocks as far as possible, but demand and supply affects it with vision variations.

http://www.marketwatch.com/news/story/Story.aspx?guid=%7B93C12C7C%2D8611%2D4394%2D8C94%2DF4571CCA31F5%7D&siteid DOWJONES high of 11,722.98 -- set on Jan. 14, 2000 -- in the past week, and its record intraday high of 11,750.28

http://www.businessstandard.com/common/storypage_c.php?leftnm=10&bKeyFlag=BO&autono=260092&chkFlg M&M buys 68% in Germany`s Jeco

http://www.businessstandard.com/common/storypage_c.php?leftnm=10&bKeyFlag=BO&autono=260093&chkFlg Wipro arm to buy Swedish firm.

http://content.icicidirect.com/market/BoardMeetings.asp

Thursday, September 28, 2006

Daily Report September 28th Thursday

To anticipate the market is to gamble; to be patient and react only when the market gives the signal is to speculate- Jesse livemore.

Nifty (3579) SUPPORT-3565-3542-3511 RESISTANCE-3607-3634-3662 Nifty range 3565-3634 being a F&O last day volatility can be more than expected, and today ONGC would be important stock to watch rs.1200 being a strong resistance. Nifty is lagging sensex by approx 3% to reach the previous high so it would be wise to look at sensex for larger moves as nifty undue weightage to ONGC can make it bit biased. TOP 5GAINERS=REL-HDFC-ORIENTBANK- MARUTI-SUZLON TOP5LOSER=M&M-HEROHONDA-BPCL-LT-WIPRO. P/E=20.87 p/b=4.74 adv=29 dec=21 NSE adv: 505 dec: 407 -vol-rs.7159crs

Sensex (12366) SUPPORT-12269-12154-12006 RESISTANCE-12431-12509-12614 Sensex opened with a gap and 12331-12339 is sustained market rally from 11444-12442 has created 3gaps now of which if 2gaps closes it would be healthy& 250 points correction would close it with today being 13th day of the rise of 998points will this happen being last day of F&O is big guess.

8dma=12190 13dma=12047 21dma=11968 34dma=11771 55dma=11335 OPEN=12359 HIGH=12442 LOW=121339 BSE adv: 1346 dec: 1157 -vol-rs.3948crs

Fiis buyer N.A & Mutual funds buyer rs.446 on Tuesday, Fiis buyer rs.4115crs in Sep month and buyer rs.21504Crs in 2006, mutual fund buyer rs.1003crs in Sep month. F&O DATA Fiis buy rs.196crs in nifty future and sell rs.95crs in stock future on 27th September and provisional Fiis buy in cash rs.410crs source NSE website

Day That Ended: Strong Euphoric opening to close with marginal gains Indian markets is moving on its own strength and we are not following global cues but we would soon see euphoria in Indian markets if DOWJONES crosses its all time high. BANKEX-HEALTHCARE where the 2sector which gained 1% while METALS had a good day too & there was news that HR coils pricing power is back which boosted steel companies. International markets U.S markets closed positive EURO markets very positive close ASIAN markets steady open with Nikkei bit stable now CRUDE has gained $62.92.

Outlook for Thursday: F&O settlement with FIIs & MF buying big this should be a day of big fight the rally for past 3yrs has been rising with its fundamental values and we saw some euphoria in APRIL-MAY which led to the crash, till markets gives good correction and till 90% of intraday player are not making money then it is a big sign euphoria hasn’t started & markets are on healthy track. I would say all good F&O stock place a buy 5-10% below yesterday close and panic would be chance to add good stocks. Value picks GDL-GAMMON-BEML-TATACHEM-CESC.

BREAKOUT stocks: http://prabhakar-views.blogspot.com MARUTI above rs.974 formation is CUP &HANDLE. RANBAXY rs.425 double top and high of almost 17weeks . AUROPHARMA RS.666 above would be major breakout.

http://in.groups.yahoo.com/group/prabhakar-views/join

Disclaimer: These recommendations are based on the theory of technical analysis and personal observations. This does not claim for profit. I am not responsible for any losses made by traders. It is only the outlook of the market with reference to its previous performance. You are advised to take your position with your sense and judgment. I am trying to consider the fundamental validity of stocks as far as possible, but demand and supply affects it with vision variations.

http://www.businessstandard.com/bsonline/storypage.php?leftnm=11&bKeyFlag=IN&autono=6155 BRICs PCG: Buy IVRCL, Orient Paper.

http://www.businessstandard.com/bsonline/storypage.php?leftnm=11&bKeyFlag=IN&autono=6162 Ranbaxy arm launches Atorvastatin generics in Malaysia.

Nifty (3579) SUPPORT-3565-3542-3511 RESISTANCE-3607-3634-3662 Nifty range 3565-3634 being a F&O last day volatility can be more than expected, and today ONGC would be important stock to watch rs.1200 being a strong resistance. Nifty is lagging sensex by approx 3% to reach the previous high so it would be wise to look at sensex for larger moves as nifty undue weightage to ONGC can make it bit biased. TOP 5GAINERS=REL-HDFC-ORIENTBANK- MARUTI-SUZLON TOP5LOSER=M&M-HEROHONDA-BPCL-LT-WIPRO. P/E=20.87 p/b=4.74 adv=29 dec=21 NSE adv: 505 dec: 407 -vol-rs.7159crs

Sensex (12366) SUPPORT-12269-12154-12006 RESISTANCE-12431-12509-12614 Sensex opened with a gap and 12331-12339 is sustained market rally from 11444-12442 has created 3gaps now of which if 2gaps closes it would be healthy& 250 points correction would close it with today being 13th day of the rise of 998points will this happen being last day of F&O is big guess.

8dma=12190 13dma=12047 21dma=11968 34dma=11771 55dma=11335 OPEN=12359 HIGH=12442 LOW=121339 BSE adv: 1346 dec: 1157 -vol-rs.3948crs

Fiis buyer N.A & Mutual funds buyer rs.446 on Tuesday, Fiis buyer rs.4115crs in Sep month and buyer rs.21504Crs in 2006, mutual fund buyer rs.1003crs in Sep month. F&O DATA Fiis buy rs.196crs in nifty future and sell rs.95crs in stock future on 27th September and provisional Fiis buy in cash rs.410crs source NSE website

Day That Ended: Strong Euphoric opening to close with marginal gains Indian markets is moving on its own strength and we are not following global cues but we would soon see euphoria in Indian markets if DOWJONES crosses its all time high. BANKEX-HEALTHCARE where the 2sector which gained 1% while METALS had a good day too & there was news that HR coils pricing power is back which boosted steel companies. International markets U.S markets closed positive EURO markets very positive close ASIAN markets steady open with Nikkei bit stable now CRUDE has gained $62.92.

Outlook for Thursday: F&O settlement with FIIs & MF buying big this should be a day of big fight the rally for past 3yrs has been rising with its fundamental values and we saw some euphoria in APRIL-MAY which led to the crash, till markets gives good correction and till 90% of intraday player are not making money then it is a big sign euphoria hasn’t started & markets are on healthy track. I would say all good F&O stock place a buy 5-10% below yesterday close and panic would be chance to add good stocks. Value picks GDL-GAMMON-BEML-TATACHEM-CESC.

BREAKOUT stocks: http://prabhakar-views.blogspot.com MARUTI above rs.974 formation is CUP &HANDLE. RANBAXY rs.425 double top and high of almost 17weeks . AUROPHARMA RS.666 above would be major breakout.

http://in.groups.yahoo.com/group/prabhakar-views/join

Disclaimer: These recommendations are based on the theory of technical analysis and personal observations. This does not claim for profit. I am not responsible for any losses made by traders. It is only the outlook of the market with reference to its previous performance. You are advised to take your position with your sense and judgment. I am trying to consider the fundamental validity of stocks as far as possible, but demand and supply affects it with vision variations.

http://www.businessstandard.com/bsonline/storypage.php?leftnm=11&bKeyFlag=IN&autono=6155 BRICs PCG: Buy IVRCL, Orient Paper.

http://www.businessstandard.com/bsonline/storypage.php?leftnm=11&bKeyFlag=IN&autono=6162 Ranbaxy arm launches Atorvastatin generics in Malaysia.

Wednesday, September 27, 2006

STOCK TECH view

STOCK TECK view: http://prabhakar-views.blogspot.com NOIDATOLL(38.8 BSE) target rs.48-52 the stock is trading around 200DMA for a long time and this stock has a potenial upside ( stocks which are low priced investor buy heavily i would caution them when u add jus have it below 3% of u r investment )

Daily Report September 27th Wednesday

Nifty (3571) SUPPORT-3549-3521-3494 RESISTANCE-3595-3622-3648 Nifty above 3549 would be bullish now this markets should be viewed different jus run profits with a tight stop loss and take profits where u feel happy as markets nears it peak stocks which hasn’t performed would give better returns. And now nifty stop loss would be 3494 for the trend on closing basis for the target of 3856. TOP 5GAINERS=WIPRO-ICICIBANK-SBIN-SUZLON-MARUTI TOP5LOSER=BPCL-MTNL-ITC-VSNL. P/E=20.83 p/b=4.73 adv=46 dec=4 NSE adv: 458 dec: 456 -vol-rs.7055crs

Sensex (12321) SUPPORT-12254-12145-12067 RESISTANCE-12411-12506-12589 Sensex opening is most important highest close ever for sensex is 12612 which would be the level to watch. Chance of gap up open is possible and for the day till 12254 is not broken we would see markets giving one more day of good gains.

8dma=12145 13dma=12012 21dma=11937 34dma=11735 55dma=11303 OPEN=12206 HIGH=12331 LOW=12160 BSE adv: 1230 dec: 1253 -vol-rs.3490crs

Fiis seller rs.268crs & Mutual funds buyer rs.223on Monday, Fiis buyer rs.4115crs in Sep month and buyer rs.21504Crs in 2006, mutual fund buyer rs.556crs in Sep month. F&O DATA Fiis buy rs.1236crs in nifty future and sell rs.49crs in stock future on 26th September and provisional Fiis buy in cash rs.14crs source NSE website

Day That Ended: Market closed stronger on BANKS-AUTO-OIL sector gains and with F&O settlement short covering & fresh buying is moving markets up & extension of pan card till DEC31 has given a breather to many investor. Hedge funds have pulled out near $16billon from commodity markets and my personnel feeling is that the speculative hot money would fuel major rally in stock markets world over. International markets almost all markets is in GREEN and Japan NIKKEI has gained 1.69% till now Indian ADRs positive CRUDE $ 61.20. World Economic Forum’s Global Competitiveness Index (GCI) gives India the chance out break out of the rank- when u read the report u will understand how well India is doing with too many drawback due to lack of political will.

Outlook for Wednesday: Market to open very positive and short covering would push markets higher with very positive global markets and many positive news flow, now investors shouldn’t get carried away it is time where u have to stick to basic. BOT- built operate transfer companies which has a good cash flow model with growing traffic would do good in years to come & these companies have shed there premium which was there before MAY2006 GAMMON-IVRCL-HCC-NCC-NOIDATOLL to name a few. Few stock looks to gain big BEML-BHARTISHIPYARD-SATYAMCOMP-WIPRO-RANBAXY-WOCKHARD-CESC-TATAPOWER-IPCL-BIOCON-EMCO-TVSMOT and now RELIANCE near its all time high rs.1184 any breakout would soon make it cross rs.1270.

STOCK TECK view: http://prabhakar-views.blogspot.com NOIDATOLL(38.8 BSE) target rs.48-52 the stock is trading around 200DMA for a long time and this stock has a potenial upside ( stocks which are low priced investor buy heavily i would caution them when u add jus have it below 3% of u r investment )

http://in.groups.yahoo.com/group/prabhakar-views/join

Disclaimer: These recommendations are based on the theory of technical analysis and personal observations. This does not claim for profit. I am not responsible for any losses made by traders. It is only the outlook of the market with reference to its previous performance. You are advised to take your position with your sense and judgment. I am trying to consider the fundamental validity of stocks as far as possible, but demand and supply affects it with vision variations.

http://www.financialexpress.com/latest_full_story.php?content_id=141564 'India could handle 30% US banking process'

http://economictimes.indiatimes.com/articleshow/2030260.cms Ranbaxy eyes US co, eyes the record book too.

Sensex (12321) SUPPORT-12254-12145-12067 RESISTANCE-12411-12506-12589 Sensex opening is most important highest close ever for sensex is 12612 which would be the level to watch. Chance of gap up open is possible and for the day till 12254 is not broken we would see markets giving one more day of good gains.

8dma=12145 13dma=12012 21dma=11937 34dma=11735 55dma=11303 OPEN=12206 HIGH=12331 LOW=12160 BSE adv: 1230 dec: 1253 -vol-rs.3490crs

Fiis seller rs.268crs & Mutual funds buyer rs.223on Monday, Fiis buyer rs.4115crs in Sep month and buyer rs.21504Crs in 2006, mutual fund buyer rs.556crs in Sep month. F&O DATA Fiis buy rs.1236crs in nifty future and sell rs.49crs in stock future on 26th September and provisional Fiis buy in cash rs.14crs source NSE website

Day That Ended: Market closed stronger on BANKS-AUTO-OIL sector gains and with F&O settlement short covering & fresh buying is moving markets up & extension of pan card till DEC31 has given a breather to many investor. Hedge funds have pulled out near $16billon from commodity markets and my personnel feeling is that the speculative hot money would fuel major rally in stock markets world over. International markets almost all markets is in GREEN and Japan NIKKEI has gained 1.69% till now Indian ADRs positive CRUDE $ 61.20. World Economic Forum’s Global Competitiveness Index (GCI) gives India the chance out break out of the rank- when u read the report u will understand how well India is doing with too many drawback due to lack of political will.

Outlook for Wednesday: Market to open very positive and short covering would push markets higher with very positive global markets and many positive news flow, now investors shouldn’t get carried away it is time where u have to stick to basic. BOT- built operate transfer companies which has a good cash flow model with growing traffic would do good in years to come & these companies have shed there premium which was there before MAY2006 GAMMON-IVRCL-HCC-NCC-NOIDATOLL to name a few. Few stock looks to gain big BEML-BHARTISHIPYARD-SATYAMCOMP-WIPRO-RANBAXY-WOCKHARD-CESC-TATAPOWER-IPCL-BIOCON-EMCO-TVSMOT and now RELIANCE near its all time high rs.1184 any breakout would soon make it cross rs.1270.

STOCK TECK view: http://prabhakar-views.blogspot.com NOIDATOLL(38.8 BSE) target rs.48-52 the stock is trading around 200DMA for a long time and this stock has a potenial upside ( stocks which are low priced investor buy heavily i would caution them when u add jus have it below 3% of u r investment )

http://in.groups.yahoo.com/group/prabhakar-views/join

Disclaimer: These recommendations are based on the theory of technical analysis and personal observations. This does not claim for profit. I am not responsible for any losses made by traders. It is only the outlook of the market with reference to its previous performance. You are advised to take your position with your sense and judgment. I am trying to consider the fundamental validity of stocks as far as possible, but demand and supply affects it with vision variations.

http://www.financialexpress.com/latest_full_story.php?content_id=141564 'India could handle 30% US banking process'

http://economictimes.indiatimes.com/articleshow/2030260.cms Ranbaxy eyes US co, eyes the record book too.

Tuesday, September 26, 2006

NATIONAL ALUMINIUM

STOCK TECK view: http://prabhakar-views.blogspot.com NATIONALUM(209) target rs.259-277 this stock moved from rs.152 to 334 in 29week and reacted till rs.185 and now 20weeks has happened so 80% of price and time has been retraced, and we would see a techincal bounce back & F&O indicators are pointing towards that and rs.215 would be a very crucial level to watch. This stock has a potential of giving above 20% return and one should have adquate stop loss so that he has a favorable risk reward ratio.

Daily Report September 26th Tuesday

“I never try to predict or anticipate. I only try to react to what the market is telling me by its behavior.”-Jesse livemore.

Nifty (3523) SUPPORT-3507-3485-3452 RESISTANCE-3548-3577-3608 Nifty would be strong if 3507 is not cut on the downside cutting which we would see a panic sell off and where we close is so important any close above 3478-3485 is very bullish sign, any close below that we would see once it happens. In case nifty stays above 3507 then upside would be very big led by METALS & POWER sector. TOP 5GAINERS=BPCL-TATASTEEL-HINDPETRO-NATIONALUM-PNB

TOP5LOSER=SUZLON-BAJAJAUTO-GRASIM-ITC-HINDLEVER. P/E=20.21 p/b=4.59 adv=18 dec=32 NSE adv: 326 dec: 592 -vol-rs.6168crs

Sensex (12173) SUPPORT-12130-12058-11932 RESISTANCE-12245-12337-12484 Sensex spending time above 12000 levels is a very good sign healthy market always moves slow and for every 8days would give 3day correction. 12130-12245 if this range is broken on either side the move would be very big and global factors are pointing to positive.

8dma=12102 13dma=11976 21dma=11903 34dma=11697 55dma=11279 OPEN=12257 HIGH=12273 LOW=12145 BSE adv: 998 dec: 1510 -vol-rs.3502crs

Fiis buyer rs.152crs & Mutual funds seller rs.135on Friday, Fiis buyer rs.4383crs in Sep month and buyer rs.21773Crs in 2006, mutual fund buyer rs.332crs in Sep month. F&O DATA Fiis sell rs.425crs in nifty future and sell rs.93crs in stock future on 25th September and provisional Fiis sell in cash rs.273crs source NSE website

Day That Ended: Markets was almost flat to turn negative with profit booking setting in towards F&O settlement, METALS & POWER is seeing heavy built up in OI, there has been a speculation of dreaded terror leader dead and news is that it is boosting sentiment of markets. International markets U.S markets positive with NASDAQ gaining 1.36% Indian ADRs major gainer in tune with global markets, EURO markets mixed ASIAN markets opened flat CRUDE $ 61.38 it saw 10months low before a bounce back.

Outlook for Tuesday: METALS & POWER sector is looking very good, TATASTEEL-NALCO-SAIL-STER-CESC-TATASPOWER-NTPC is where action can become large and CG sector EMCO-BEL-BEML also started to see good activity. In stock markets u should decide to which group u belong to day trader, speculator, gambler, value investor, swing trader & E.T.C and suitably follow as if one doesn’t understand this basic difference money can’t be made and below I have given Jesse livemore link please read.

STOCK TECK view: http://prabhakar-views.blogspot.com NATIONALUM(209) target rs.259-277 this stock moved from rs.152 to 334 in 29week and reacted till rs.185 and now 20weeks has happened so 80% of price and time has been retraced, and we would see a techincal bounce back & F&O indicators are pointing towards that and rs.215 would be a very crucial level to watch. This stock has a potential of giving above 20% return and one should have adquate stop loss so that he has a favorable risk reward ratio.

http://in.groups.yahoo.com/group/prabhakar-views/join

Counter view: Jesse livermore speculator guidelines. 1) Don’t lose money.

Don’t lose your stake. A speculator without cash is like a store-owner with no inventory. Cash is your inventory, your lifeline, and your best friend. Without cash, you are out of business. Don’t lose your line. There is no place in speculating for hoping, for guessing, for fear, for greed, for emotions. The tape tells the truth. 2) Always establish a stop.

A successful speculator must set a firm stop before making a trade and must never sustain a loss of more than 10 percent of invested capital. I have also learned that when your broker calls you and tells you he needs more money for a margin requirement on a stock that is declining, tell him to sell out the position. When you buy a stock at 50 and it goes to 45, do not buy more in order to average out your price. The stock has not done what you predicted; that is enough of an indication that your judgment was wrong. Take your losses quickly and get out. Remember, never meet a margin call, and never average losses. Many times I would close out a position before suffering a 10 percent loss. I did this simply because the stock was not acting right from the start. Often my instincts would whisper to me: “J.L., this stock has a malaise, it is a lagging dullard. It just does not feel right,” and I would sell out of my position in the blink of an eye. I absolutely believe that price movement patterns are repeated and appear over and over with slight variations. This is because humans drive the stocks, and human nature never changes. Take your losses quickly, Easy to say, but hard to do. http://in.groups.yahoo.com/group/prabhakar-views/files/daily%20update FILE NAME JESSE LIVEMORE jus download and read more.

Disclaimer: These recommendations are based on the theory of technical analysis and personal observations. This does not claim for profit. I am not responsible for any losses made by traders. It is only the outlook of the market with reference to its previous performance. You are advised to take your position with your sense and judgment. I am trying to consider the fundamental validity of stocks as far as possible, but demand and supply affects it with vision variations.

Nifty (3523) SUPPORT-3507-3485-3452 RESISTANCE-3548-3577-3608 Nifty would be strong if 3507 is not cut on the downside cutting which we would see a panic sell off and where we close is so important any close above 3478-3485 is very bullish sign, any close below that we would see once it happens. In case nifty stays above 3507 then upside would be very big led by METALS & POWER sector. TOP 5GAINERS=BPCL-TATASTEEL-HINDPETRO-NATIONALUM-PNB

TOP5LOSER=SUZLON-BAJAJAUTO-GRASIM-ITC-HINDLEVER. P/E=20.21 p/b=4.59 adv=18 dec=32 NSE adv: 326 dec: 592 -vol-rs.6168crs

Sensex (12173) SUPPORT-12130-12058-11932 RESISTANCE-12245-12337-12484 Sensex spending time above 12000 levels is a very good sign healthy market always moves slow and for every 8days would give 3day correction. 12130-12245 if this range is broken on either side the move would be very big and global factors are pointing to positive.

8dma=12102 13dma=11976 21dma=11903 34dma=11697 55dma=11279 OPEN=12257 HIGH=12273 LOW=12145 BSE adv: 998 dec: 1510 -vol-rs.3502crs

Fiis buyer rs.152crs & Mutual funds seller rs.135on Friday, Fiis buyer rs.4383crs in Sep month and buyer rs.21773Crs in 2006, mutual fund buyer rs.332crs in Sep month. F&O DATA Fiis sell rs.425crs in nifty future and sell rs.93crs in stock future on 25th September and provisional Fiis sell in cash rs.273crs source NSE website

Day That Ended: Markets was almost flat to turn negative with profit booking setting in towards F&O settlement, METALS & POWER is seeing heavy built up in OI, there has been a speculation of dreaded terror leader dead and news is that it is boosting sentiment of markets. International markets U.S markets positive with NASDAQ gaining 1.36% Indian ADRs major gainer in tune with global markets, EURO markets mixed ASIAN markets opened flat CRUDE $ 61.38 it saw 10months low before a bounce back.

Outlook for Tuesday: METALS & POWER sector is looking very good, TATASTEEL-NALCO-SAIL-STER-CESC-TATASPOWER-NTPC is where action can become large and CG sector EMCO-BEL-BEML also started to see good activity. In stock markets u should decide to which group u belong to day trader, speculator, gambler, value investor, swing trader & E.T.C and suitably follow as if one doesn’t understand this basic difference money can’t be made and below I have given Jesse livemore link please read.

STOCK TECK view: http://prabhakar-views.blogspot.com NATIONALUM(209) target rs.259-277 this stock moved from rs.152 to 334 in 29week and reacted till rs.185 and now 20weeks has happened so 80% of price and time has been retraced, and we would see a techincal bounce back & F&O indicators are pointing towards that and rs.215 would be a very crucial level to watch. This stock has a potential of giving above 20% return and one should have adquate stop loss so that he has a favorable risk reward ratio.

http://in.groups.yahoo.com/group/prabhakar-views/join

Counter view: Jesse livermore speculator guidelines. 1) Don’t lose money.

Don’t lose your stake. A speculator without cash is like a store-owner with no inventory. Cash is your inventory, your lifeline, and your best friend. Without cash, you are out of business. Don’t lose your line. There is no place in speculating for hoping, for guessing, for fear, for greed, for emotions. The tape tells the truth. 2) Always establish a stop.

A successful speculator must set a firm stop before making a trade and must never sustain a loss of more than 10 percent of invested capital. I have also learned that when your broker calls you and tells you he needs more money for a margin requirement on a stock that is declining, tell him to sell out the position. When you buy a stock at 50 and it goes to 45, do not buy more in order to average out your price. The stock has not done what you predicted; that is enough of an indication that your judgment was wrong. Take your losses quickly and get out. Remember, never meet a margin call, and never average losses. Many times I would close out a position before suffering a 10 percent loss. I did this simply because the stock was not acting right from the start. Often my instincts would whisper to me: “J.L., this stock has a malaise, it is a lagging dullard. It just does not feel right,” and I would sell out of my position in the blink of an eye. I absolutely believe that price movement patterns are repeated and appear over and over with slight variations. This is because humans drive the stocks, and human nature never changes. Take your losses quickly, Easy to say, but hard to do. http://in.groups.yahoo.com/group/prabhakar-views/files/daily%20update FILE NAME JESSE LIVEMORE jus download and read more.

Disclaimer: These recommendations are based on the theory of technical analysis and personal observations. This does not claim for profit. I am not responsible for any losses made by traders. It is only the outlook of the market with reference to its previous performance. You are advised to take your position with your sense and judgment. I am trying to consider the fundamental validity of stocks as far as possible, but demand and supply affects it with vision variations.

Monday, September 25, 2006

BSE METAL INDEX

STOCK TECH view

STOCK TECK view: http://prabhakar-views.blogspot.com MARUTI rs.920-935 wait for dips to buy as F&O expiry normally gives chances target rs.1050-1075 and even higher, on weekly charts rs.902 is the double bottom(below which one should place a stop loss) and now stock reacted near all time high with cup & handle formation. Stock can be good for positional traders.

Sunday, September 24, 2006

Daily Report September 25th Monday

The secret to success in the markets lies not in discovering some incredible indicator or elaborate theory; rather, it lies within each individual.

Nifty (3544) SUPPORT-3520-3498-3475 RESISTANCE-3577-3605-3638 Nifty range 3514-3577 with last 4days of F&O settlement and sun outage markets would be very volatile and with good rollover seen we would see markets being weak in the open and recover towards close and vice versa till settlement. RELIANCE is one stock to watch out for settlement as close above rs.1145 is very good one more close above with would reach all time high. TOP 5GAINERS= GAIL-ORIENTBANK-JETAIRWAYS-GRASIM-RELIANCE TOP5LOSER=ZEETELE-SATYAMCOMP-DABUR-MTNL-BPCL. P/E=20.33 p/b=4.62 adv=20 dec=30 NSE adv: 261 dec: 652 -vol-rs.6435crs

Sensex (12236) SUPPORT-12163-12098-11997 RESISTANCE-12322-12415-12508 Sensex the gap is acting strong support and if on Monday if the gap (12128-12167) is not closed fully chances of markets having a 5days of mega rally is possible where new high also can be possible, and the rally is able to sustain above 12000 comfortably 3out 5days it was above 12000 the more it stays there higher targets would be possible soon.

8dma=12067 13dma=11958 21dma=11874 34dma=11657 55dma=11243 OPEN=12244 HIGH=12303 LOW=12170 BSE adv: 898 dec: 1607 -vol-rs.3108crs

Fiis buyer rs.288crs & Mutual funds buyer rs.194on Thursday, Fiis buyer rs.4321crs in Sep month and buyer rs.21621Crs in 2006, mutual fund buyer rs.468crs in Sep month. F&O DATA Fiis sell rs.1135crs in nifty future and sell rs.148crs in stock future on 22nd September and provisional Fiis sell in cash rs.119crs source NSE website

Day That Ended: Market maintained negative bias through out being a weekend closing and weak global markets cues but Reliance industries gave the needed recovery to markets towards the end, and there is a big shifting of F&O happening after 6months which shows a positive bias in markets. International markets U.S markets ended weak Indian ADRs also ended weak EURO markets in deep red CRUDE $ 60.55 & Petroleum Minister Murli Deora said petro products prices will be cut can be very good news.

Outlook for Monday: Markets to open weak based on weak global cues and slowdown in U.S economy, but that wouldn’t affect our markets. BSEMETAL index has gaped up and 2days it was able to sustain that NALCO-TATASTEEL-SAIL-HINDALCO-STER are stock which can surprise markets and many news flow would come soon. News of petro prices cut would benefit 2WHEELER-LOGISTICS sector AEGISLOGISTICS-GDL-TVSMOTORS would be value picks.

STOCK TECK view: http://prabhakar-views.blogspot.com MARUTI rs.920-935 wait for dips to buy as F&O expiry normally gives chances target rs.1050-1075 and even higher, on weekly charts rs.902 is the double bottom(below which one should place a stop loss) and now stock reacted near all time high with cup & handle formation. Stock can be good for positional traders.

http://in.groups.yahoo.com/group/prabhakar-views/join

Counter view: Advance tax figure(37% higher corparates have paid) has come and once the F&O settlement is over markets would look at results season where CEMENT companies has outperformed and a report which says middle east demand is high 30% premuim is paid and local demand also very high and in weak season also pricing power is seen, METALS also have paid good taxes above wat markets expected and this has surprised many and now I see many reports which had given sell now coming out with buy saying cost reduction local demand to sustain. The above views would explain how competive the research of companies have become, and as I normally say today there are more analsyts than stock listed so each and every move of the stock is timed execpt for the euopria and panic times in markets and markets are too fast to adjust themselves back so never time markets it is always correct and it has proved so always. I would like to add many are worried about market correction that would come and that would go and no one can ever stop it you are here to make money and u should know to keep things simple. Curtail u r losses to minimum and profit automatically grows, know u r stock, divide u r risk & remember markets always changes sectors so have laggards which has a visible growth in longer term. Remember buy on rumour sell on news is so true as now itself many would have projected the results and the stock would start to price itself and when the news comes the charm is not there & this hold for bad & good results.

Disclaimer: These recommendations are based on the theory of technical analysis and personal observations. This does not claim for profit. I am not responsible for any losses made by traders. It is only the outlook of the market with reference to its previous performance. You are advised to take your position with your sense and judgment. I am trying to consider the fundamental validity of stocks as far as possible, but demand and supply affects it with vision variations.

http://today.reuters.com/news/articlenews.aspx?type=businessNews&storyid=2006-09-23T020900Z_01_N22233854_RTRUKOC_0_US-COLUMN-STOCKS-OUTLOOK.xml&src=rss Slowdown fears cloud stocks' horizon .

http://www.rediff.com/money/2006/sep/23fab.htm

http://www.businessstandard.com/common/storypage_c.php?leftnm=11&bKeyFlag=IN&autono=5998 Petro prices may decline: Deora.

Nifty (3544) SUPPORT-3520-3498-3475 RESISTANCE-3577-3605-3638 Nifty range 3514-3577 with last 4days of F&O settlement and sun outage markets would be very volatile and with good rollover seen we would see markets being weak in the open and recover towards close and vice versa till settlement. RELIANCE is one stock to watch out for settlement as close above rs.1145 is very good one more close above with would reach all time high. TOP 5GAINERS= GAIL-ORIENTBANK-JETAIRWAYS-GRASIM-RELIANCE TOP5LOSER=ZEETELE-SATYAMCOMP-DABUR-MTNL-BPCL. P/E=20.33 p/b=4.62 adv=20 dec=30 NSE adv: 261 dec: 652 -vol-rs.6435crs

Sensex (12236) SUPPORT-12163-12098-11997 RESISTANCE-12322-12415-12508 Sensex the gap is acting strong support and if on Monday if the gap (12128-12167) is not closed fully chances of markets having a 5days of mega rally is possible where new high also can be possible, and the rally is able to sustain above 12000 comfortably 3out 5days it was above 12000 the more it stays there higher targets would be possible soon.

8dma=12067 13dma=11958 21dma=11874 34dma=11657 55dma=11243 OPEN=12244 HIGH=12303 LOW=12170 BSE adv: 898 dec: 1607 -vol-rs.3108crs

Fiis buyer rs.288crs & Mutual funds buyer rs.194on Thursday, Fiis buyer rs.4321crs in Sep month and buyer rs.21621Crs in 2006, mutual fund buyer rs.468crs in Sep month. F&O DATA Fiis sell rs.1135crs in nifty future and sell rs.148crs in stock future on 22nd September and provisional Fiis sell in cash rs.119crs source NSE website

Day That Ended: Market maintained negative bias through out being a weekend closing and weak global markets cues but Reliance industries gave the needed recovery to markets towards the end, and there is a big shifting of F&O happening after 6months which shows a positive bias in markets. International markets U.S markets ended weak Indian ADRs also ended weak EURO markets in deep red CRUDE $ 60.55 & Petroleum Minister Murli Deora said petro products prices will be cut can be very good news.

Outlook for Monday: Markets to open weak based on weak global cues and slowdown in U.S economy, but that wouldn’t affect our markets. BSEMETAL index has gaped up and 2days it was able to sustain that NALCO-TATASTEEL-SAIL-HINDALCO-STER are stock which can surprise markets and many news flow would come soon. News of petro prices cut would benefit 2WHEELER-LOGISTICS sector AEGISLOGISTICS-GDL-TVSMOTORS would be value picks.

STOCK TECK view: http://prabhakar-views.blogspot.com MARUTI rs.920-935 wait for dips to buy as F&O expiry normally gives chances target rs.1050-1075 and even higher, on weekly charts rs.902 is the double bottom(below which one should place a stop loss) and now stock reacted near all time high with cup & handle formation. Stock can be good for positional traders.

http://in.groups.yahoo.com/group/prabhakar-views/join

Counter view: Advance tax figure(37% higher corparates have paid) has come and once the F&O settlement is over markets would look at results season where CEMENT companies has outperformed and a report which says middle east demand is high 30% premuim is paid and local demand also very high and in weak season also pricing power is seen, METALS also have paid good taxes above wat markets expected and this has surprised many and now I see many reports which had given sell now coming out with buy saying cost reduction local demand to sustain. The above views would explain how competive the research of companies have become, and as I normally say today there are more analsyts than stock listed so each and every move of the stock is timed execpt for the euopria and panic times in markets and markets are too fast to adjust themselves back so never time markets it is always correct and it has proved so always. I would like to add many are worried about market correction that would come and that would go and no one can ever stop it you are here to make money and u should know to keep things simple. Curtail u r losses to minimum and profit automatically grows, know u r stock, divide u r risk & remember markets always changes sectors so have laggards which has a visible growth in longer term. Remember buy on rumour sell on news is so true as now itself many would have projected the results and the stock would start to price itself and when the news comes the charm is not there & this hold for bad & good results.

Disclaimer: These recommendations are based on the theory of technical analysis and personal observations. This does not claim for profit. I am not responsible for any losses made by traders. It is only the outlook of the market with reference to its previous performance. You are advised to take your position with your sense and judgment. I am trying to consider the fundamental validity of stocks as far as possible, but demand and supply affects it with vision variations.

http://today.reuters.com/news/articlenews.aspx?type=businessNews&storyid=2006-09-23T020900Z_01_N22233854_RTRUKOC_0_US-COLUMN-STOCKS-OUTLOOK.xml&src=rss Slowdown fears cloud stocks' horizon .

http://www.rediff.com/money/2006/sep/23fab.htm

http://www.businessstandard.com/common/storypage_c.php?leftnm=11&bKeyFlag=IN&autono=5998 Petro prices may decline: Deora.

Friday, September 22, 2006

STOCK TECH view

STOCK TECK view: http://prabhakar-views.blogspot.com IPCL stock has given a breakout and should target rs.340-350 which is 10-12% from the current close this is a trading movemutum stock where u buy higher & sell higher as this stock has enetered uncharted territory so a strict stop loss at rs.298 is to be maintained.

Daily Report September 22nd Friday

Nifty (3553) SUPPORT-3528-3504-3486 RESISTANCE-3580-3605-3638 nifty staying above 3528 would target higher levels any correction in intraday short covering would push markets up & now stop loss for 3856 target is pegged at 3471. High speculative (short or long) position square up would happen due to sun outage which would keep markets very volatile. TOP 5GAINERS= ORIENTBANK-HINDLEVER-BAJAJAUTO-SUZLON-BHEL TOP5LOSER=JETAIRWAYS-HEROHONDA-RCOM-LT-ZEETELE. P/E=20.38 p/b=4.63 adv=45 dec=5 NSE adv: 557 dec: 357 -vol-rs.7132crs

Sensex (12274) SUPPORT-12218-12130-12040 RESISTANCE-12348-12456-12564 Sensex created one more gap up 12128-12167(which would be a strong support) and there was no sign of markets correcting to fill the gap instead we closed above the major pain area 12238 and important would be highest weekly close for sensex is at 12359 & today’s close if it happens above that it would boost the sentiment.

8dma=11995 13dma=11932 21dma=11841 34dma=11616 55dma=11217 OPEN=12167 HIGH=12285 LOW=12167 BSE adv: 1372 dec: 1138 -vol-rs.3453crs

Fiis buyer rs.236crs & Mutual funds seller rs.269on Wednesday, Fiis buyer rs.3942crs in Sep month and buyer rs.21332Crs in 2006, mutual fund buyer rs.276crs in Sep month. F&O DATA Fiis buy rs.962crs in nifty future and sell rs.154crs in stock future on 21ST September and provisional Fiis buy in cash rs.235crs source NSE website

Day That Ended: Markets opened strong and advanced to close near the days high, many advance tax figures where reported by media which I have listed below & these figure gave a big boost to markets already report suggest that 36% higher advance tax paid by corporate & Advance tax payment of 8 Sensex firms up 400% in Q2. All sector gave gains and FMCG gained on pricing power coming back after HLL hiked prices and ITC rumour of doing so AUTO stock moves on lower crude & metal price. International market U.S markets corrected INDIAN ADRs also corrected with sentiment of U.S market EURO MARKETS closed positive ASIAN markets has opened on a weak note CRUDE-$61.90.

Outlook for Friday: Markets would see some speculative square off due to sun outage which starts from Monday25SEP has been the worst time for traders & ends Monday9OCT (time when market changes course after break). CEMENT-METALS-AUTO advance tax payments have surprised markets, PHARMA is one sector which is attracting lots of attention. Market is at a high risk zone and investor should know the risk of wat they are doing as stock markets world over are effected by many events which is not so easily understandable sometimes accessible (for EG. THAI military rule) so protect urself always well and F&O & margin funding is very risky at this stage.

ACC-GUJAMBCEMENT-GRASIM-TATASTEEL-NALCO-HINDALCO-M&M-IPCL-BIOCON-LLYODELECENGEERING would be stock which can give 5-8% in 7-10days.

STOCK TECK view: http://prabhakar-views.blogspot.com IPCL stock has given a breakout and should target rs.340-350 which is 10-12% from the current close this is a trading movemutum stock where u buy higher & sell higher as this stock has enetered uncharted territory so a strict stop loss at rs.298 is to be maintained.

http://in.groups.yahoo.com/group/prabhakar-views/join

Disclaimer: These recommendations are based on the theory of technical analysis and personal observations. This does not claim for profit. I am not responsible for any losses made by traders. It is only the outlook of the market with reference to its previous performance. You are advised to take your position with your sense and judgment. I am trying to consider the fundamental validity of stocks as far as possible, but demand and supply affects it with vision variations.

Advance Tax (Sept, YoY): SBI - Rs 863 crore Vs Rs 559 crore

Advance Tax (Sept, YoY): ICICI Bank - Rs 450 crore Vs Rs 250 crore

Advance Tax (Sept, YoY): RIL - Rs 446 crore Vs Rs 253 crore

Advance Tax (Sept, YoY): IOC - Rs 211 crore Vs NIL

Advance Tax (Sept, YoY): HDFC Bank - Rs 160 crore Vs Rs 120 crore

Advance Tax (Sept, YoY): Grasim - Rs 155 crore Vs Rs 80 crore

Advance Tax (Sept, YoY): BOB - Rs 150 crore Vs Rs 110 crore

Advance Tax (Sept, YoY): Bajaj Auto - Rs 125 crore Vs Rs 110 crore

Advance Tax (Sept, YoY): ACC - Rs 125 crore Vs Rs 5 crore

Advance Tax (Sept, YoY): Guj Amb - Rs 120 crore Vs Rs 20 crore

Advance Tax (Sept, YoY): BPCL - Rs 105 crore Vs NIL

Advance Tax (Sept, YoY): Siemens - Rs 45 crore Vs Rs 28.5 crore

Advance Tax (Sept, YoY): HLL - Rs 80 crore Vs Rs 60 crore

Advance Tax (Sept, YoY): M&M - Rs 99 crore Vs Rs 46 crore

Advance Tax (Sept, YoY): L&T - Rs 80 crore Vs Rs 50 crore

Advance Tax (Sept, YoY): Tata Motors - Rs 75 crore Vs Rs 55 crore

Advance Tax (Sept, YoY): Tatachem- Rs.56crore VS Rs 50 crore

Advance Tax (Sept, YoY): Hindalco-Rs 230 crore Vs Rs 135 crore

http://www.financialexpress.com/fe_full_story.php?content_id=141175 Advance tax payment of 8 Sensex firms up 400% in Q2

http://www.businessstandard.com/common/storypage_c.php?leftnm=11&bKeyFlag=IN&autono=5930 US to be hit by recesssion in '07: Spence.

http://www.financialexpress.com/latest_full_story.php?content_id=141094 L&T to earn Rs 4 bn from expansion

Sensex (12274) SUPPORT-12218-12130-12040 RESISTANCE-12348-12456-12564 Sensex created one more gap up 12128-12167(which would be a strong support) and there was no sign of markets correcting to fill the gap instead we closed above the major pain area 12238 and important would be highest weekly close for sensex is at 12359 & today’s close if it happens above that it would boost the sentiment.

8dma=11995 13dma=11932 21dma=11841 34dma=11616 55dma=11217 OPEN=12167 HIGH=12285 LOW=12167 BSE adv: 1372 dec: 1138 -vol-rs.3453crs

Fiis buyer rs.236crs & Mutual funds seller rs.269on Wednesday, Fiis buyer rs.3942crs in Sep month and buyer rs.21332Crs in 2006, mutual fund buyer rs.276crs in Sep month. F&O DATA Fiis buy rs.962crs in nifty future and sell rs.154crs in stock future on 21ST September and provisional Fiis buy in cash rs.235crs source NSE website

Day That Ended: Markets opened strong and advanced to close near the days high, many advance tax figures where reported by media which I have listed below & these figure gave a big boost to markets already report suggest that 36% higher advance tax paid by corporate & Advance tax payment of 8 Sensex firms up 400% in Q2. All sector gave gains and FMCG gained on pricing power coming back after HLL hiked prices and ITC rumour of doing so AUTO stock moves on lower crude & metal price. International market U.S markets corrected INDIAN ADRs also corrected with sentiment of U.S market EURO MARKETS closed positive ASIAN markets has opened on a weak note CRUDE-$61.90.

Outlook for Friday: Markets would see some speculative square off due to sun outage which starts from Monday25SEP has been the worst time for traders & ends Monday9OCT (time when market changes course after break). CEMENT-METALS-AUTO advance tax payments have surprised markets, PHARMA is one sector which is attracting lots of attention. Market is at a high risk zone and investor should know the risk of wat they are doing as stock markets world over are effected by many events which is not so easily understandable sometimes accessible (for EG. THAI military rule) so protect urself always well and F&O & margin funding is very risky at this stage.

ACC-GUJAMBCEMENT-GRASIM-TATASTEEL-NALCO-HINDALCO-M&M-IPCL-BIOCON-LLYODELECENGEERING would be stock which can give 5-8% in 7-10days.

STOCK TECK view: http://prabhakar-views.blogspot.com IPCL stock has given a breakout and should target rs.340-350 which is 10-12% from the current close this is a trading movemutum stock where u buy higher & sell higher as this stock has enetered uncharted territory so a strict stop loss at rs.298 is to be maintained.

http://in.groups.yahoo.com/group/prabhakar-views/join

Disclaimer: These recommendations are based on the theory of technical analysis and personal observations. This does not claim for profit. I am not responsible for any losses made by traders. It is only the outlook of the market with reference to its previous performance. You are advised to take your position with your sense and judgment. I am trying to consider the fundamental validity of stocks as far as possible, but demand and supply affects it with vision variations.

Advance Tax (Sept, YoY): SBI - Rs 863 crore Vs Rs 559 crore

Advance Tax (Sept, YoY): ICICI Bank - Rs 450 crore Vs Rs 250 crore

Advance Tax (Sept, YoY): RIL - Rs 446 crore Vs Rs 253 crore

Advance Tax (Sept, YoY): IOC - Rs 211 crore Vs NIL

Advance Tax (Sept, YoY): HDFC Bank - Rs 160 crore Vs Rs 120 crore

Advance Tax (Sept, YoY): Grasim - Rs 155 crore Vs Rs 80 crore

Advance Tax (Sept, YoY): BOB - Rs 150 crore Vs Rs 110 crore

Advance Tax (Sept, YoY): Bajaj Auto - Rs 125 crore Vs Rs 110 crore

Advance Tax (Sept, YoY): ACC - Rs 125 crore Vs Rs 5 crore

Advance Tax (Sept, YoY): Guj Amb - Rs 120 crore Vs Rs 20 crore

Advance Tax (Sept, YoY): BPCL - Rs 105 crore Vs NIL

Advance Tax (Sept, YoY): Siemens - Rs 45 crore Vs Rs 28.5 crore

Advance Tax (Sept, YoY): HLL - Rs 80 crore Vs Rs 60 crore

Advance Tax (Sept, YoY): M&M - Rs 99 crore Vs Rs 46 crore

Advance Tax (Sept, YoY): L&T - Rs 80 crore Vs Rs 50 crore

Advance Tax (Sept, YoY): Tata Motors - Rs 75 crore Vs Rs 55 crore

Advance Tax (Sept, YoY): Tatachem- Rs.56crore VS Rs 50 crore

Advance Tax (Sept, YoY): Hindalco-Rs 230 crore Vs Rs 135 crore

http://www.financialexpress.com/fe_full_story.php?content_id=141175 Advance tax payment of 8 Sensex firms up 400% in Q2

http://www.businessstandard.com/common/storypage_c.php?leftnm=11&bKeyFlag=IN&autono=5930 US to be hit by recesssion in '07: Spence.

http://www.financialexpress.com/latest_full_story.php?content_id=141094 L&T to earn Rs 4 bn from expansion

Thursday, September 21, 2006

STOCK TECH view

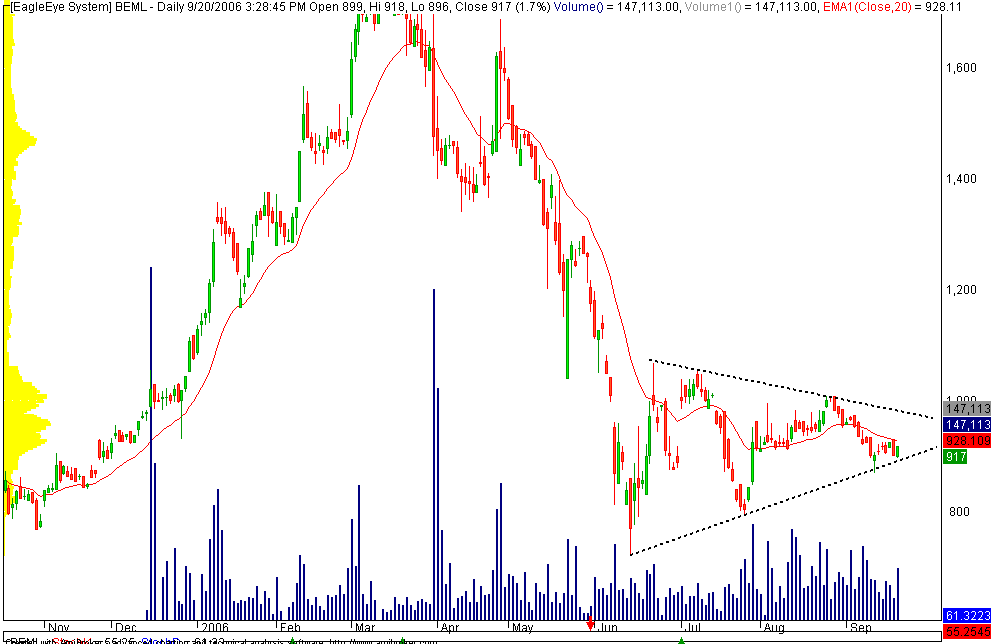

STOCK TECK view: http://prabhakar-views.blogspot.com BEML buy rs.900-940 target rs.1500 the stock has been in good accumlation for a very long time and now volumes and delivery volumes are slowly picking up and any move above rs.980 would be a major breakout and a return of 67% would be very good if it happens in 12-15months also in my view it can be faster.

Daily Report September 21st Thursday

Nifty (3502) SUPPORT-3482-3455-3336 RESISTANCE-3530-3555-3584 Nifty now should trade above 3515 comfortably & intraday we shouldn’t trade below 3486 are 2major points for markets today and if both criteria are met it would be one of the higher gains today and now stop loss for 3856 has been changed from 3370 to 3436. TOP 5GAINERS=BHARTIATL-RCOM-IPCL-ORIENTBANK-TCS TOP5LOSER=HDFCBANK-ABB-SBIN-BPCL-SUNPHARMA. P/E=20.09 p/b=4.51 adv=40 dec=9 NSE adv: 449 dec: 453 -vol-rs.6571crs

Sensex (12109) SUPPORT-12024-11905-11836 RESISTANCE-12178-12285-12342 Sensex should trade above 12024 to signify the bullish trend this is for intraday and in short term too, and volatility should come down as many uncertain events are over and we trading above the major pain area 12238 would be very important.

8dma=11904 13dma=11904 21dma=11800 34dma=11577 55dma=11192 OPEN=11946 HIGH=12128 LOW=11833 BSE adv: 1266 dec: 1255 -vol-rs.3416crs

Fiis buyer rs.276crs & Mutual funds buyer rs.127on Tuesday, Fiis buyer rs.3706crs in Sep month and buyer rs.21096Crs in 2006, mutual fund buyer rs.609crs in Sep month. F&O DATA Fiis buy rs.118crs in nifty future and sell rs.18crs in stock future on 20th September and provisional Fiis buy in cash rs.128crs source NSE website

Day That Ended: Market opened weak with panic downfall to recover faster and all losses made on Tuesday was gained and closed above as more clarity has emerged about FED-THAI MILTARYCOUP-HEDGEFUND. Volumes are lower & gains were from all sector but TECH-AUTO-FMCG were major gainers and they would be strong too in coming days, International Monetary Fund (IMF) today promised to carry out further reforms that would open up the possibility of more powers in the fund for India- which are pointers that India is growing into a major super cycle economy. International markets U.S markets closed positive and Indian ADRs highest gain in recent time EURO markets positive close and ASIAN markets has opened strong CRUDE $60.90.

Outlook for Thursday: Market to maintain its upward journey and with Crude almost 25% down OIL marketing company should do very well and company which use crude byproduct also should fare well. Metals coming down would benefit ENGEERING-AUTO would raw material cost pressure would come down soon & PHARMA-TECH would be great Indian story soon. HINDSANTITARY-BEML-BHARTISHIPYARD-EMCO-BIOCON-WOCKHARD-AUROPHARMA-RANBAXY-HPCL-BPCL-TATACHEM-CESC-WIPRO-RAYMOND-GAMMON-GDL all same old stock where investor can have a look at.

STOCK TECK view: http://prabhakar-views.blogspot.com BEML buy rs.900-940 target rs.1500 the stock has been in good accumlation for a very long time and now volumes and delivery volumes are slowly picking up and any move above rs.980 would be a major breakout and a return of 67% would be very good if it happens in 12-15months also in my view it can be faster.

http://in.groups.yahoo.com/group/prabhakar-views/join

Disclaimer: These recommendations are based on the theory of technical analysis and personal observations. This does not claim for profit. I am not responsible for any losses made by traders. It is only the outlook of the market with reference to its previous performance. You are advised to take your position with your sense and judgment. I am trying to consider the fundamental validity of stocks as far as possible, but demand and supply affects it with vision variations.

http://economictimes.indiatimes.com/articleshow/2011774.cms Thai coup pushes India, Inc. for risk cover.

http://www.businessstandard.com/bsonline/storypage.php?leftnm=11&bKeyFlag=IN&autono=5834

http://economictimes.indiatimes.com/articleshow/2011939.cms Tatas plan mega foray into durables retail biz.

http://www.businessstandard.com/bsonline/storypage.php?leftnm=11&bKeyFlag=IN&autono=5817 Gabriel to demerge engine bearings unit

Sensex (12109) SUPPORT-12024-11905-11836 RESISTANCE-12178-12285-12342 Sensex should trade above 12024 to signify the bullish trend this is for intraday and in short term too, and volatility should come down as many uncertain events are over and we trading above the major pain area 12238 would be very important.

8dma=11904 13dma=11904 21dma=11800 34dma=11577 55dma=11192 OPEN=11946 HIGH=12128 LOW=11833 BSE adv: 1266 dec: 1255 -vol-rs.3416crs

Fiis buyer rs.276crs & Mutual funds buyer rs.127on Tuesday, Fiis buyer rs.3706crs in Sep month and buyer rs.21096Crs in 2006, mutual fund buyer rs.609crs in Sep month. F&O DATA Fiis buy rs.118crs in nifty future and sell rs.18crs in stock future on 20th September and provisional Fiis buy in cash rs.128crs source NSE website

Day That Ended: Market opened weak with panic downfall to recover faster and all losses made on Tuesday was gained and closed above as more clarity has emerged about FED-THAI MILTARYCOUP-HEDGEFUND. Volumes are lower & gains were from all sector but TECH-AUTO-FMCG were major gainers and they would be strong too in coming days, International Monetary Fund (IMF) today promised to carry out further reforms that would open up the possibility of more powers in the fund for India- which are pointers that India is growing into a major super cycle economy. International markets U.S markets closed positive and Indian ADRs highest gain in recent time EURO markets positive close and ASIAN markets has opened strong CRUDE $60.90.

Outlook for Thursday: Market to maintain its upward journey and with Crude almost 25% down OIL marketing company should do very well and company which use crude byproduct also should fare well. Metals coming down would benefit ENGEERING-AUTO would raw material cost pressure would come down soon & PHARMA-TECH would be great Indian story soon. HINDSANTITARY-BEML-BHARTISHIPYARD-EMCO-BIOCON-WOCKHARD-AUROPHARMA-RANBAXY-HPCL-BPCL-TATACHEM-CESC-WIPRO-RAYMOND-GAMMON-GDL all same old stock where investor can have a look at.

STOCK TECK view: http://prabhakar-views.blogspot.com BEML buy rs.900-940 target rs.1500 the stock has been in good accumlation for a very long time and now volumes and delivery volumes are slowly picking up and any move above rs.980 would be a major breakout and a return of 67% would be very good if it happens in 12-15months also in my view it can be faster.

http://in.groups.yahoo.com/group/prabhakar-views/join

Disclaimer: These recommendations are based on the theory of technical analysis and personal observations. This does not claim for profit. I am not responsible for any losses made by traders. It is only the outlook of the market with reference to its previous performance. You are advised to take your position with your sense and judgment. I am trying to consider the fundamental validity of stocks as far as possible, but demand and supply affects it with vision variations.

http://economictimes.indiatimes.com/articleshow/2011774.cms Thai coup pushes India, Inc. for risk cover.

http://www.businessstandard.com/bsonline/storypage.php?leftnm=11&bKeyFlag=IN&autono=5834

http://economictimes.indiatimes.com/articleshow/2011939.cms Tatas plan mega foray into durables retail biz.

http://www.businessstandard.com/bsonline/storypage.php?leftnm=11&bKeyFlag=IN&autono=5817 Gabriel to demerge engine bearings unit

Wednesday, September 20, 2006

STOCK TECH view

STOCK TECK view: http://prabhakar-views.blogspot.com SATYAMCOMP(837) nearing its double top rs.890 which is 52week high this stock all time high is rs.1400above and with markets correcting also this one stock has been stable and in overnight U.S markets also the stock has gained all inspite of rumour denied by the company about any possible takeover, Watch out for a breakout soon.

Daily Report September 20th Wednesday

Nifty (3457) SUPPORT-3439-3411-3388 RESISTANCE-3490-3515-3541 Nifty 3431 holds the key for Wednesday & till we don’t break 3370 on the downside these correction are healthy and gives chance to buy in short term. If markets trade around 3430 for first one hour of trade the up move would be big. TOP 5GAINERS=SATYAMCOMP-RCOM-TCS-ABB-ICICIBANK TOP5LOSER=ZEETELE-IPCL-VSNL-JETAIRWAYS-TATAMOTORS. P/E=19.83 p/b=4.51 adv=5 dec=45 NSE adv: 259 dec: 660 -vol-rs.7518crs

Sensex (11970) SUPPORT-11902-11836-11705 RESISTANCE-12084-12140-12238 Sensex today correction made all investor nervous and FED rate meeting on SEP20 and we here would know only on SEP21 made nervous operators to unwind there speculative position.

8dma=11881 13dma=11879 21dma=11771 34dma=11540 55dma=11166 OPEN=12103 HIGH=12152 LOW=11915 BSE adv: 944 dec: 1589 -vol-rs.3704crs

Fiis buyer rs.495crs & Mutual funds seller rs.2on Monday, Fiis buyer rs.3430crs in Sep month and buyer rs.20819Crs in 2006, mutual fund buyer rs.482crs in Sep month. F&O DATA Fiis buy rs.149crs in nifty future and sell rs.113crs in stock future on 19th September and provisional Fiis buy in cash rs.174crs source NSE website

Day That Ended: Markets opened on a strong note and selling near last 45mins send the markets down 2.5% from the high and the fall has been with low volumes and data suggests that lack of follow up buying at higher levels and unwinding of speculative positive before FED meet on SEP20. Rumour doing rounds 1) hedge fund Amaranth Advisors lost $5 billion last week on natural gas trades 2)state of emergency was declared in Thailand and rumors of a military coup followed. Crude $61.60 almost near (58.95)52week low International market U.S markets closed weak jus a day before FED meet EURO markets in deep losses ASIAN markets Indian ADRs were weak after THAI coup as all ASIAN ADRs were facing selling pressure and Dollars is getting stronger against major ASIAN currencies.

Outlook for Wednesday: Volatile day ahead with both short (and) long traders would like avoid overnight position as last FED meet after day 100points rise in nifty was seen and short didn’t get chance to square there position. If u r trader avoid markets as THAI effect on our markets is unknown & markets never like uncertainty THAI-FED-HEDGEFUND. Investors shouldn’t worry about markets correction as these give opportunity to buy good stocks as reasonable levels BIOCON-BEML-RANBAXY-RAYMOND-WOCKHARD-EMCO-HINDSANITARY-GAMMON-TATACHEM-BATAINDIA-CESC-GACEMENT-HPCL-WIPRO-TCS.

STOCK TECK view: http://prabhakar-views.blogspot.com SATYAMCOMP(837) nearing its double top rs.890 which is 52week high this stock all time high is rs.1400above and with markets correcting also this one stock has been stable and in overnight U.S markets also the stock has gained all inspite of rumour denied by the company about any possible takeover, Watch out for a breakout soon.

Counter view: News of hedge funds losing almost 50% in commodity trading has sent a shock wave into that industry which hasn’t been regulated in any markets. We have seen high Crude, Gold & other commodity prices due to excess speculation from these funds jus few days back I had mentioned about gold falling something in graph says the fall will be big and it can happen if these hedge funds reduce there risky assets. Now it has time and again proved that speculation has never been successful & losers are never talked about, 99% lose 1% gain it is jus like a lottery. Buffett's way of thinking, you shouldn't dream of owning a stock for 10 minutes that you're not prepared to hold for 10 years. Day-to-day movements in the stock price are irrelevant; so are ups and downs in a company's quarterly earnings. "An investor should act as though he had a lifetime decision card with just 20 punches on it," Buffett says. That means buying a few good companies and sticking with them for the long haul.

Disclaimer: These recommendations are based on the theory of technical analysis and personal observations. This does not claim for profit. I am not responsible for any losses made by traders. It is only the outlook of the market with reference to its previous performance. You are advised to take your position with your sense and judgment. I am trying to consider the fundamental validity of stocks as far as possible, but demand and supply affects it with vision variations.

http://www.cbsnews.com/stories/2006/09/19/ap/business/mainD8K81GMG0.shtml Stocks Off on Rumors of Coup in Thailand.

http://www.kfoxtv.com/news/9884808/detail.html Military Coup Reported In Thailand

http://www.bloomberg.com/apps/news?pid=20601083&sid=axAUZ5Up1lrM&refer=currency Australian Dollar Falls on Thai Coup and Weak Commodity Prices

http://economictimes.indiatimes.com/articleshow/2006794.cms Goldman Sachs to invest $1bn in India.

http://economictimes.indiatimes.com/articleshow/2007983.cms Wockhardt to sell Dumex's dairy unit.

Sensex (11970) SUPPORT-11902-11836-11705 RESISTANCE-12084-12140-12238 Sensex today correction made all investor nervous and FED rate meeting on SEP20 and we here would know only on SEP21 made nervous operators to unwind there speculative position.

8dma=11881 13dma=11879 21dma=11771 34dma=11540 55dma=11166 OPEN=12103 HIGH=12152 LOW=11915 BSE adv: 944 dec: 1589 -vol-rs.3704crs

Fiis buyer rs.495crs & Mutual funds seller rs.2on Monday, Fiis buyer rs.3430crs in Sep month and buyer rs.20819Crs in 2006, mutual fund buyer rs.482crs in Sep month. F&O DATA Fiis buy rs.149crs in nifty future and sell rs.113crs in stock future on 19th September and provisional Fiis buy in cash rs.174crs source NSE website

Day That Ended: Markets opened on a strong note and selling near last 45mins send the markets down 2.5% from the high and the fall has been with low volumes and data suggests that lack of follow up buying at higher levels and unwinding of speculative positive before FED meet on SEP20. Rumour doing rounds 1) hedge fund Amaranth Advisors lost $5 billion last week on natural gas trades 2)state of emergency was declared in Thailand and rumors of a military coup followed. Crude $61.60 almost near (58.95)52week low International market U.S markets closed weak jus a day before FED meet EURO markets in deep losses ASIAN markets Indian ADRs were weak after THAI coup as all ASIAN ADRs were facing selling pressure and Dollars is getting stronger against major ASIAN currencies.

Outlook for Wednesday: Volatile day ahead with both short (and) long traders would like avoid overnight position as last FED meet after day 100points rise in nifty was seen and short didn’t get chance to square there position. If u r trader avoid markets as THAI effect on our markets is unknown & markets never like uncertainty THAI-FED-HEDGEFUND. Investors shouldn’t worry about markets correction as these give opportunity to buy good stocks as reasonable levels BIOCON-BEML-RANBAXY-RAYMOND-WOCKHARD-EMCO-HINDSANITARY-GAMMON-TATACHEM-BATAINDIA-CESC-GACEMENT-HPCL-WIPRO-TCS.

STOCK TECK view: http://prabhakar-views.blogspot.com SATYAMCOMP(837) nearing its double top rs.890 which is 52week high this stock all time high is rs.1400above and with markets correcting also this one stock has been stable and in overnight U.S markets also the stock has gained all inspite of rumour denied by the company about any possible takeover, Watch out for a breakout soon.

Counter view: News of hedge funds losing almost 50% in commodity trading has sent a shock wave into that industry which hasn’t been regulated in any markets. We have seen high Crude, Gold & other commodity prices due to excess speculation from these funds jus few days back I had mentioned about gold falling something in graph says the fall will be big and it can happen if these hedge funds reduce there risky assets. Now it has time and again proved that speculation has never been successful & losers are never talked about, 99% lose 1% gain it is jus like a lottery. Buffett's way of thinking, you shouldn't dream of owning a stock for 10 minutes that you're not prepared to hold for 10 years. Day-to-day movements in the stock price are irrelevant; so are ups and downs in a company's quarterly earnings. "An investor should act as though he had a lifetime decision card with just 20 punches on it," Buffett says. That means buying a few good companies and sticking with them for the long haul.

Disclaimer: These recommendations are based on the theory of technical analysis and personal observations. This does not claim for profit. I am not responsible for any losses made by traders. It is only the outlook of the market with reference to its previous performance. You are advised to take your position with your sense and judgment. I am trying to consider the fundamental validity of stocks as far as possible, but demand and supply affects it with vision variations.

http://www.cbsnews.com/stories/2006/09/19/ap/business/mainD8K81GMG0.shtml Stocks Off on Rumors of Coup in Thailand.

http://www.kfoxtv.com/news/9884808/detail.html Military Coup Reported In Thailand

http://www.bloomberg.com/apps/news?pid=20601083&sid=axAUZ5Up1lrM&refer=currency Australian Dollar Falls on Thai Coup and Weak Commodity Prices

http://economictimes.indiatimes.com/articleshow/2006794.cms Goldman Sachs to invest $1bn in India.

http://economictimes.indiatimes.com/articleshow/2007983.cms Wockhardt to sell Dumex's dairy unit.

Tuesday, September 19, 2006

STOCK TECH view

Daily Report September 19th Tuesday

Nifty (3492) SUPPORT-3474-3450-3434 RESISTANCE-3528-3555-3583 Nifty range 3480-3535 now if markets stays above 3500 we would soon target higher levels and 3856 which was given as target for Oct end also would be possible and for that target-(3856) stop loss is pegged at 3370.TOP 5GAINERS=SUZLON-HDFC-RCOM-HINDLEVER-ITC TOP5LOSER=TATAPOWER-TATASTEEL-NATIONALUM-TATAMOTORS-ONGC. P/E=20.03 p/b=4.55 adv=34 dec=18 NSE adv: 508 dec: 410 -vol-rs.6090crs

Sensex (12071) SUPPORT-12003-11945-11836 RESISTANCE-12159-12238-12348 Sensex today traded above 12000 mark and didn’t come down and it has done this 10th time in its life time which is so important, markets is moving up in a measured way slowly there are jus 2pain area 12238 & 12671 and after which whole markets would become bullish.

8dma=11866 13dma=11858 21dma=11749 34dma=11505 55dma=11143 OPEN=12006 HIGH=12114 LOW=12006 BSE adv: 1286 dec: 1199 -vol-rs.2893crs

Fiis buyer rs.459crs & Mutual funds seller rs.98on Friday, Fiis buyer rs.2935crs in Sep month and buyer rs.20324Crs in 2006, mutual fund buyer rs.401crs in Sep month. F&O DATA Fiis buy rs.149crs in nifty future and sell rs.113crs in stock future on 18th September and provisional Fiis buy in cash rs.373crs source NSE website

Day That Ended: Market opened positive and remained firm throughout the day and closed positive volumes where low while advances healthy than decline, 4new stock added in F&O is seeing good activity for past few days. FMCG-CG-PHARMA sectors where in action while metals were weak many small cap & mid cap stocks where in action and that is where many good growth stocks are there but one must be very selective. International markets U.S markets closed flat Indian ADRs mixed EURO markets closed positive and ASIAN markets have opened very strong Crude $ 63.92.

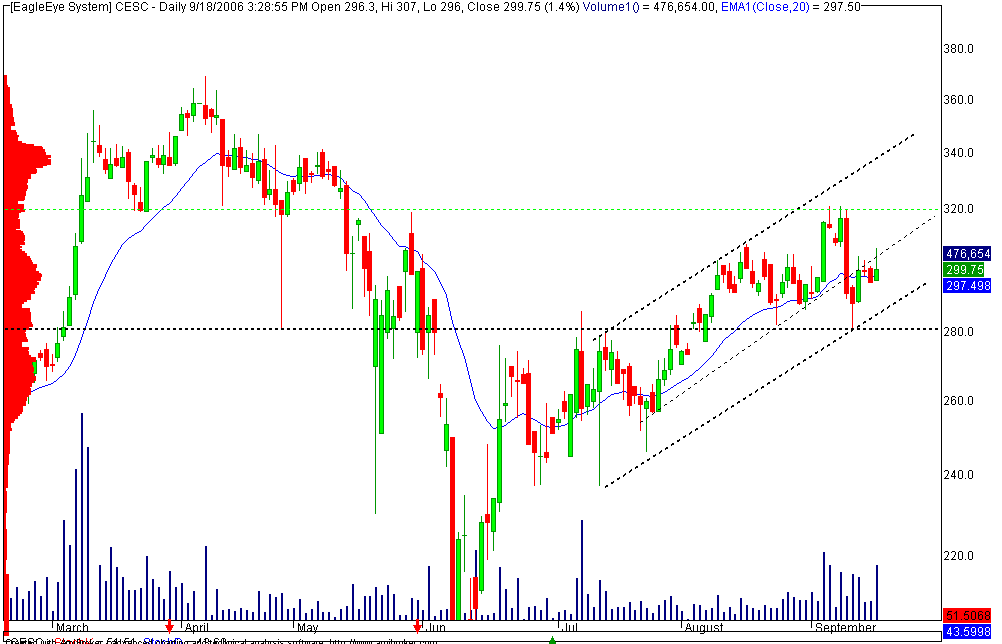

Outlook for Tuesday: Bullish view few stocks are near breakout or given breakout which would be big gainers if that happens CESC added 500% OI, RANBAXY rs.422 above breakout, CUMMINS rs.225 above, WOCKHARD rs.408 above. GAIL is moving in a channel where 250-290 would be the range so one can buy in dips and 10% gain possible in short time. BAJAJHIND can target rs.365 now rs.330, BAJAJ auto breakout above rs.2835 these are all indicative as markets has changed too much that each day it is not the same stock or sector which move up so a traders should know levels. LONG TERM investor can add CESC-TATACHEM-BEML-BIOCON-RANBAXY-BATAINDIA-RAYMOND-HINDOILEXPO in very slow and steady way.

http://in.groups.yahoo.com/group/prabhakar-views/join many files uploaded would be very useful please download and read.

STOCK TECK view: http://prabhakar-views.blogspot.com CESC buy rs.290-300 target rs.370-400 stop loss rs.280 below and the stock looks very attractive in many ways short term-medium term & long term and with huge speculative position built trend traders also will see a major upmove.

Disclaimer: These recommendations are based on the theory of technical analysis and personal observations. This does not claim for profit. I am not responsible for any losses made by traders. It is only the outlook of the market with reference to its previous performance. You are advised to take your position with your sense and judgment. I am trying to consider the fundamental validity of stocks as far as possible, but demand and supply affects it with vision variations.

Sensex (12071) SUPPORT-12003-11945-11836 RESISTANCE-12159-12238-12348 Sensex today traded above 12000 mark and didn’t come down and it has done this 10th time in its life time which is so important, markets is moving up in a measured way slowly there are jus 2pain area 12238 & 12671 and after which whole markets would become bullish.

8dma=11866 13dma=11858 21dma=11749 34dma=11505 55dma=11143 OPEN=12006 HIGH=12114 LOW=12006 BSE adv: 1286 dec: 1199 -vol-rs.2893crs

Fiis buyer rs.459crs & Mutual funds seller rs.98on Friday, Fiis buyer rs.2935crs in Sep month and buyer rs.20324Crs in 2006, mutual fund buyer rs.401crs in Sep month. F&O DATA Fiis buy rs.149crs in nifty future and sell rs.113crs in stock future on 18th September and provisional Fiis buy in cash rs.373crs source NSE website

Day That Ended: Market opened positive and remained firm throughout the day and closed positive volumes where low while advances healthy than decline, 4new stock added in F&O is seeing good activity for past few days. FMCG-CG-PHARMA sectors where in action while metals were weak many small cap & mid cap stocks where in action and that is where many good growth stocks are there but one must be very selective. International markets U.S markets closed flat Indian ADRs mixed EURO markets closed positive and ASIAN markets have opened very strong Crude $ 63.92.

Outlook for Tuesday: Bullish view few stocks are near breakout or given breakout which would be big gainers if that happens CESC added 500% OI, RANBAXY rs.422 above breakout, CUMMINS rs.225 above, WOCKHARD rs.408 above. GAIL is moving in a channel where 250-290 would be the range so one can buy in dips and 10% gain possible in short time. BAJAJHIND can target rs.365 now rs.330, BAJAJ auto breakout above rs.2835 these are all indicative as markets has changed too much that each day it is not the same stock or sector which move up so a traders should know levels. LONG TERM investor can add CESC-TATACHEM-BEML-BIOCON-RANBAXY-BATAINDIA-RAYMOND-HINDOILEXPO in very slow and steady way.

http://in.groups.yahoo.com/group/prabhakar-views/join many files uploaded would be very useful please download and read.

STOCK TECK view: http://prabhakar-views.blogspot.com CESC buy rs.290-300 target rs.370-400 stop loss rs.280 below and the stock looks very attractive in many ways short term-medium term & long term and with huge speculative position built trend traders also will see a major upmove.