Nifty (3430) SUPPORT-3416-3394-3357 RESISTANCE-3464-3490-3540 Nifty range 3416-3464 any move above 3464 would be a major upside, downside has many support and with last day of F&O a good panic in stocks would be chance to buy. Few ratio in option point that we would see a major upside today so I have avoided a trailing stop loss. TOP 5GAINERS=BPCL-HINDPETRO-RANBAXY-PNB-MTNL TOP5LOSER=SAIL-TATAPOWER-REL-TATASTEEL-NATIONALUM. P/E=19.25 p/b=4.58 adv=26 dec=23 NSE adv: 341 dec: 570 -vol-rs.5803crs

Sensex (11723) SUPPORT-11648-11585-11510 RESISTANCE-11804-11910-12040 Sensex gap narrowed down 11633-11643 but market has maintained its bullish outlook so any panic would be a chance to add stocks and levels above 12000 soon in my view. There would be days where investors and day traders should avoid markets and today would be one, markets is always correct and we would get it wrong so never time markets.

8dma=11571 13dma=11497 21dma=11286 34dma=10968 55dma=10730 OPEN=11735 HIGH=11756 LOW=11643 BSE adv: 1066 dec: 1474 -vol-rs.2715crs

Fiis buyer rs.368crs and Mutual funds buyer rs.73crs on Monday, Fiis buyer rs.4306crs in August month and buyer rs.17052Crs in 2006, mutual fund buyer rs.313crs in August month. F&O DATA Fiis buy rs.184crs in nifty future and sell rs.167crs in stock future on 30th August and provisional Fiis buy in cash rs.287crs source NSE website

Day That Ended: Markets stable with no major gains but sectors rotation was visible METALS losing OIL marketing & FMCG gaining high, GAMMONINDIA had many block deals with 35lac volumes and 91% delivery. RBI came out with its annual report which gave loan growth which was impressive even after 200 basis point rise in interest and RBI maintained growth at 8% GDP which would be a booster to stock markets and BANKS in particular. International markets U.S markets closed with margin gains with Crude which touched 5months low to close at $70.38 Indian ADRs closing mostly negative EURO market closed very positively and ASIAN markets has opened on a very positive note.

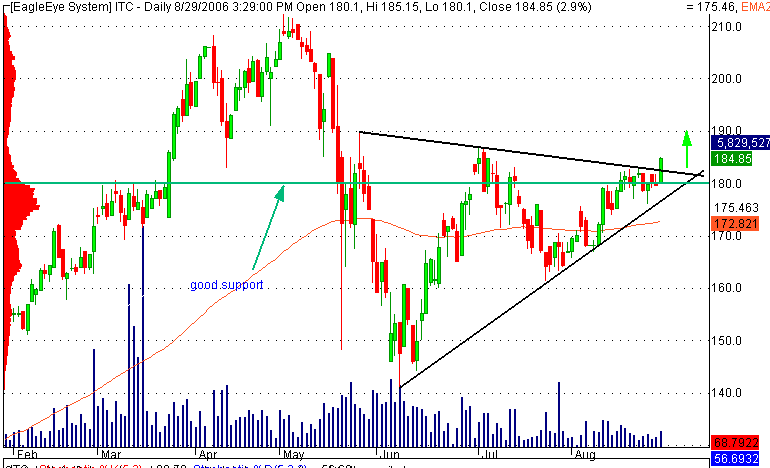

Outlook for Thursday: LAST day of F&O expiry & month there is a positive undertone but will markets give a big upside is wat we will have to see there can be a big spurt in bank stocks & construction stocks. Markets always give good chance to buy and sell last day of F&O expiry few stocks can have panic sale or spurt due to short covering these should be used effectively and METAL stocks if they have panic sale(8-10% down) would be a chance to add. ITC-WIPRO-TCS-IVRCL-BIOCON-BEML-BHEL-BHARTISHIPYARD-HINDSANTIWARE are stocks one can add in panic.

STOCK TECH view: MAHAVIRSPINNING: buy rs.285-290 target rs.335-340 below rs.275 its stops target should be possible by 1-2 months. HINDSANTIWARE buy rs.104-108 target rs.150 which is above 40% & above gain would take 4-5months charts are showing strong accumulation use panic in markets to add.

NEWS:

United Phosphorus has purchased certain crop protection products from Bayer Crop Science for a consideration of Euro 43.50 million, including inventories.(BS)

Aurobindo Pharma may hive off research facility, joining the dedicated R&D company bandwagon, the Rs 1,500 crore bulk drug Major Aurobindo Pharma is planning to hive off its research and development division into a separate company.(BS)

A sharp 54% jump in housing loans helped retail lending grow 47% in the first quarter of the current fiscal, according to the RBI annual report released on Wednesday. The spike in retail lending comes despite a 200 basis point hike in interest rates in the last one year.(FE)

GDP growth to stay above 8%, Riding on the back of manufacturing and services sector performance, Indian economy is likely to clock above 8 per cent growth rate almost nearing the last year performance of 8.4 per cent, industry body Assocham's survey (ET)

FMCG major Hindustan Lever Ltd (HLL) would scale up the number of Ayush Therapy centres (ATCs) to 100 in next two years and would focus on addition of new value-added services. & Hindustan Lever Ltd has diluted its stake in the Tata group company Tata Chemicals through sale of a part of its shareholding for about Rs 94.4 crore. (ET)

Nicholas Piramal India Ltd on Wednesday said its group company and diagnostic laboratories chain, Wellspring, has acquired the remaining 40 per cent stake in its joint venture with Dr Phadke's Path Labs for Rs 14 crore.(ET)

http://in.groups.yahoo.com/group/prabhakar-views/join join and view files and links it is like a library.

Disclaimer: trade in stock market is high risk& high return and I do not accept any financial and/or legal responsibility arising the use of the information this is no offer to buy/sell jus my views to share.

http://www.financialexpress.com/fe_full_story.php?content_id=138941 sharp 54% jump in housing loans.

http://www.thehindubusinessline.com/2006/08/31/stories/2006083103490100.htm Defence: Govt to partner industry

http://www.financialexpress.com/latest_full_story.php?content_id=138953 India needs to review energy taxes: Montek

Thursday, August 31, 2006

Wednesday, August 30, 2006

Daily Report August 30th Wednesday

Nifty (3425) SUPPORT-3405-3388-3357 RESISTANCE-3442-3478-3519 Nifty range 3396-3478 markets has closed more toward positive bias with last 2days of F&O expiry and the volatility is not so high but stock specific movement would be larger now. F&O expiry so below 3392 if markets stay a sell off till 3357 is also possible. TOP 5GAINERS=MARUTI-ITC-SUNPHARMA-WIPRO-HDFC TOP5LOSER=HINDLEVER-TATASTEEL-BPCL-IPCL-ORIENTBANK . P/E=19.22 p/b=4.64 adv=27 dec=22 NSE adv: 436 dec: 478 -vol-rs.5750crs

Sensex (11706) SUPPORT-11651-11570-11492 RESISTANCE-11798-11910-12040 Sensex has gaped up 11633-11651 so till this gap is not closed one can have a bullish view 12000 above levels can also be possible soon. SBIN would be a stock to watch in next 2days it can target rs.980 levels also if rs.900 above levels is maintained.

8dma=11539 13dma=11453 21dma=11239 34dma=10945 55dma=10679 OPEN=11651 HIGH=11739 LOW=11651 BSE adv: 1249 dec: 1269 -vol-rs.2710crs

Fiis buyer rs.43crs and Mutual funds seller rs.10crs on Monday, Fiis buyer rs.3937crs in August month and buyer rs.16683Crs in 2006, mutual fund buyer rs.240crs in August month. F&O DATA Fiis buy rs.289crs in nifty future and sell rs.90crs in stock future on 29th August and provisional Fiis buy in cash rs.202crs source NSE website

Day That Ended: Market opened on positive note but volumes is still a worry, failing Crude $69.93 helped the sentiment and sectors which led the gains are TECH-CONSUMER DURABLE while METALS was a notable loser after news that small price cut in steel would come. Fiis buying almost rs.4000crs and above in the month of August is a big sentiment booster and with Crude almost near 4month low and FED rate hike can face one more pause would be lead Indian markets to highest gain on monthly basis with still 2trading days left. International markets U.S market closed positive and Indian ADRs closed higher EURO market mixed and ASIAN markets opened positive.

Outlook for Wednesday: 2days more for month end close & F&O expiry also falls on that date so markets can surprise and big upside in next 2days is not ruled out as there is no major selling pressure from Fiis &MF and both have turned net buyer for the month. There is a major sector rotation and with lower crude would benefit stocks which are linked to that. WIPRO has given a breakout and would target higher levels soon and TECH stocks in general looking good on charts TCS-INFOSYS-SATYAM can give 10-15% returns soon.

STOCK TECH view: HPCL buy around rs.265-275 for a target of rs.320-330 soon stops below rs.254. BPCL buy around rs.348-355 target rs.420-430 stops below rs.338 holding period can be 1-2months.

NEWS:

Bharat Heavy Electricals (BHEL) today announced a roadmap for expanding power equipment manufacturing capacity to 10,000 MW annually at an investment of more than Rs 1,600 crore.(BS)

The board of Steel Authority of India (SAIL) today approved an investment of Rs 350 crore for three modernisation and expansion projects at its Bhilai and Bokaro plants.(BS)

Suven Life Sciences has signed an agreement with US-based Eli Lilly and Company to collaborate on pre-clinical research of molecules in the therapeutic area of central nervous system (CNS) disorders.(BS)

Tulip IT Services has received the national long distance (NLD) licence from the Department of Telecommunications (DoT).(BS)

Tata Steel, which said in June it planned to raise up to $1.4 billion through one or more equity-related sales, has invited investment banks to pitch for a $500 million-$600 million Global Depository Receipt (GDR) offering, sources said.(ET)

Domestic manufacturers of hot-rolled steel are likely to reduce prices from September 1. However, the quantum of reduction is yet to be decided and is likely to be finalized within the next two days.(BL)

ITC Ltd is scouting for prime locations to set up hotels in West Bengal. It is exploring a clutch of options, including launching these hotels under the Fortune or WelcomHeritage, two key brands in its hotels portfolio.(ET)

Hinduja TMT is scheduled to meet on August 31, 2006 to consider a scheme of

Arrangement and restructuring by way of the demerger of the company's IT & IES undertaking into a separate company.(BS)

[Dow Jones] STOCK CALL: First Global starts GAIL with a market perform rating, although valuations (at 9.3X FY07E) "extremely low as compared to that of the other global majors"; says its valuations justified "given the high regulatory risk in India". Adds, "going forward, there are a number of potential triggers, although their timing and form isn't yet clear due to various regulatory roadblocks".

[Dow Jones] WALL STREET: Stocks mounted Fed-induced comeback with techs out in front; DJIA +0.2% after early 52 point fall, NASDAQ +0.5%, Philly semicons +1.7%. Market struggled for much of session but turned positive midafternoon after release of FOMC minutes from last meeting; "the Fed made no statement that rate hikes would resume anytime soon, if at all. Also, oil breaking below the psychological 70 dollar barrier added to the positive tone.

(Dow Jones)--Capgemini the French information-technology and consulting company, has lined up $500 million for acquisitions in India , a senior company official said Tuesday.

(DJ) EADS Says To Invest EUR2Bln In India Over 15 Years EADS Chief Executive Tom Enders made the announcement during meetings with senior Indian officials. Enders is in India as a member of a German delegation headed by the country's Minister of Economics and Technology, Michael Glos .

(Bloomberg) -- National Aluminum Co., India's biggest producer of alumina, expects second-half profit to decline because of falling prices of the raw material used to make the lightweight metal.

http://in.groups.yahoo.com/group/prabhakar-views/join join and view files and links it is like a library.

Disclaimer: trade in stock market is high risk& high return and I do not accept any financial and/or legal responsibility arising the use of the information this is no offer to buy/sell jus my views to share.

http://www.businessstandard.com/bsonline/storypage.php?leftnm=11&bKeyFlag=IN&autono=4894 IPCL buy-out tussle may be headed for arbitration.

http://www.bloomberg.com/apps/news?pid=20601087&sid=a6w3xjaWVJgI&refer=worldwide_news Fed Pause `Close Call'; Officials Unsure of Outlook

--

Sensex (11706) SUPPORT-11651-11570-11492 RESISTANCE-11798-11910-12040 Sensex has gaped up 11633-11651 so till this gap is not closed one can have a bullish view 12000 above levels can also be possible soon. SBIN would be a stock to watch in next 2days it can target rs.980 levels also if rs.900 above levels is maintained.

8dma=11539 13dma=11453 21dma=11239 34dma=10945 55dma=10679 OPEN=11651 HIGH=11739 LOW=11651 BSE adv: 1249 dec: 1269 -vol-rs.2710crs

Fiis buyer rs.43crs and Mutual funds seller rs.10crs on Monday, Fiis buyer rs.3937crs in August month and buyer rs.16683Crs in 2006, mutual fund buyer rs.240crs in August month. F&O DATA Fiis buy rs.289crs in nifty future and sell rs.90crs in stock future on 29th August and provisional Fiis buy in cash rs.202crs source NSE website

Day That Ended: Market opened on positive note but volumes is still a worry, failing Crude $69.93 helped the sentiment and sectors which led the gains are TECH-CONSUMER DURABLE while METALS was a notable loser after news that small price cut in steel would come. Fiis buying almost rs.4000crs and above in the month of August is a big sentiment booster and with Crude almost near 4month low and FED rate hike can face one more pause would be lead Indian markets to highest gain on monthly basis with still 2trading days left. International markets U.S market closed positive and Indian ADRs closed higher EURO market mixed and ASIAN markets opened positive.

Outlook for Wednesday: 2days more for month end close & F&O expiry also falls on that date so markets can surprise and big upside in next 2days is not ruled out as there is no major selling pressure from Fiis &MF and both have turned net buyer for the month. There is a major sector rotation and with lower crude would benefit stocks which are linked to that. WIPRO has given a breakout and would target higher levels soon and TECH stocks in general looking good on charts TCS-INFOSYS-SATYAM can give 10-15% returns soon.

STOCK TECH view: HPCL buy around rs.265-275 for a target of rs.320-330 soon stops below rs.254. BPCL buy around rs.348-355 target rs.420-430 stops below rs.338 holding period can be 1-2months.

NEWS:

Bharat Heavy Electricals (BHEL) today announced a roadmap for expanding power equipment manufacturing capacity to 10,000 MW annually at an investment of more than Rs 1,600 crore.(BS)

The board of Steel Authority of India (SAIL) today approved an investment of Rs 350 crore for three modernisation and expansion projects at its Bhilai and Bokaro plants.(BS)

Suven Life Sciences has signed an agreement with US-based Eli Lilly and Company to collaborate on pre-clinical research of molecules in the therapeutic area of central nervous system (CNS) disorders.(BS)

Tulip IT Services has received the national long distance (NLD) licence from the Department of Telecommunications (DoT).(BS)

Tata Steel, which said in June it planned to raise up to $1.4 billion through one or more equity-related sales, has invited investment banks to pitch for a $500 million-$600 million Global Depository Receipt (GDR) offering, sources said.(ET)

Domestic manufacturers of hot-rolled steel are likely to reduce prices from September 1. However, the quantum of reduction is yet to be decided and is likely to be finalized within the next two days.(BL)

ITC Ltd is scouting for prime locations to set up hotels in West Bengal. It is exploring a clutch of options, including launching these hotels under the Fortune or WelcomHeritage, two key brands in its hotels portfolio.(ET)

Hinduja TMT is scheduled to meet on August 31, 2006 to consider a scheme of

Arrangement and restructuring by way of the demerger of the company's IT & IES undertaking into a separate company.(BS)

[Dow Jones] STOCK CALL: First Global starts GAIL with a market perform rating, although valuations (at 9.3X FY07E) "extremely low as compared to that of the other global majors"; says its valuations justified "given the high regulatory risk in India". Adds, "going forward, there are a number of potential triggers, although their timing and form isn't yet clear due to various regulatory roadblocks".

[Dow Jones] WALL STREET: Stocks mounted Fed-induced comeback with techs out in front; DJIA +0.2% after early 52 point fall, NASDAQ +0.5%, Philly semicons +1.7%. Market struggled for much of session but turned positive midafternoon after release of FOMC minutes from last meeting; "the Fed made no statement that rate hikes would resume anytime soon, if at all. Also, oil breaking below the psychological 70 dollar barrier added to the positive tone.

(Dow Jones)--Capgemini the French information-technology and consulting company, has lined up $500 million for acquisitions in India , a senior company official said Tuesday.

(DJ) EADS Says To Invest EUR2Bln In India Over 15 Years EADS Chief Executive Tom Enders made the announcement during meetings with senior Indian officials. Enders is in India as a member of a German delegation headed by the country's Minister of Economics and Technology, Michael Glos .

(Bloomberg) -- National Aluminum Co., India's biggest producer of alumina, expects second-half profit to decline because of falling prices of the raw material used to make the lightweight metal.

http://in.groups.yahoo.com/group/prabhakar-views/join join and view files and links it is like a library.

Disclaimer: trade in stock market is high risk& high return and I do not accept any financial and/or legal responsibility arising the use of the information this is no offer to buy/sell jus my views to share.

http://www.businessstandard.com/bsonline/storypage.php?leftnm=11&bKeyFlag=IN&autono=4894 IPCL buy-out tussle may be headed for arbitration.

http://www.bloomberg.com/apps/news?pid=20601087&sid=a6w3xjaWVJgI&refer=worldwide_news Fed Pause `Close Call'; Officials Unsure of Outlook

--

Tuesday, August 29, 2006

STOCK TECH view

STOCK TECH view: BIOCON this stock was recommended at lower levels it reached rs.403 and corrected now at rs.370-380 one can buy it can cross rs.430 soon so reward in my view looks attractive and long term target can be much higher. WOCKHARD is a clear underperformer in this rally and would soon catch up in my view investor with a longer term view can accumulate the stock.

Daily Report August 29th Tuesday

Nifty (3401) SUPPORT-3380-3361-3337 RESISTANCE-3435-3475-3504 Nifty range 3380-3475 and higher levels profit booking would come but in case we close above 3450-3470 we could see another 100-150points rise in last 2days of F&O expiry. ONGC-RELIANCE would be the stock to be watch RIL above 1126 would target rs.1160-1190 and even above soon, and strict trailing stop loss is maintained at 3355 for nifty. TOP 5GAINERS=HINDPETRO-BPCL-LT-HINDALCO-RANBAXY TOP5LOSER=DRREDDY-GAIL-SUNPHARMA-ZEETELE-CIPLA. P/E=19 p/b=4.58 adv=31 dec=16 NSE adv:543 dec:363 -vol-rs.4830crs

Sensex (11619) SUPPORT-11556-11482-11426 RESISTANCE-11688-11765-11877 Sensex above 11635 should give a big upside but now we should not break 11500 on the downside on the higher side 11930 which has been a major resistance & support in last rally would be one place were sensex would find a major resistance.

8dma=11510 13dma=11410 21dma=11190 34dma=10913 55dma=10631 OPEN=11583 HIGH=11633 LOW=11552 BSE adv: 1431 dec: 1047 -vol-rs.2364crs

Fiis buyer rs.67crs and Mutual funds buyer rs.193crs on Friday, Fiis buyer rs.3893crs in August month and buyer rs.16640Crs in 2006, mutual fund buyer rs.251crs in August month. F&O DATA Fiis sell rs.67crs in nifty future and sell rs.8crs in stock future on 28th August and provisional Fiis sell in cash rs.32crs source NSE website

Day That Ended: LOW volume day with no major activity and late buying made markets close at higher levels Crude $70.50 & FED would pause rate hike could be reasons for the late rally. BSEMETAL-CAPITALGOODS-OIL&GAS were noticeable gainers but very low volume and positive advance decline ratio is not a good sign, if the low volume is due to festival season then it is understandable. International markets U.S markets end higher as oil prices pull back Market also enlivened by mergers and acquisitions, Indian ADRs closed positive, EURO markets closed positive and ASIAN markets has opened on a very positive note.

Outlook for Tuesday: HPCL-BPCL would be the best stock for the day and they can give fast returns of 10-15% returns very soon. BIOCON-GDL-HIMATSEIDE-HINDSANTIARY-AMTEKAUTO-WOCKHARD-TVSMOTORS-PUNJABTRACTOR would be stock which would give good returns in short term. And fall of crude due to many factors would boost many stocks related to it IPCL-HPCL-BPCL-GAIL-RELIANCE-CENTURYENKA-INDORAMASYS-POLYPLEX-XPROINDIA are few stocks many packing-manmadefibre industry stocks there.

http://prabhakar-views.blogspot.com/2006/08/crude-can-crash.html this was about crude.

Mylan take over of Matrix lab would open the floodgates for many more takeovers & tie-up in pharma (VALUE PICK) WOCKHARD-BIOCON-ORCHIDCHEM- CIPLA-RANABXY.

STOCK TECH view: BIOCON this stock was recommended at lower levels it reached rs.403 and corrected now at rs.370-380 one can buy it can cross rs.430 soon so reward in my view looks attractive and long term target can be much higher. WOCKHARD is a clear underperformer in this rally and would soon catch up in my view investor with a longer term view can accumulate the stock.

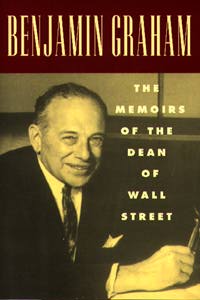

Counter view: Profit in stock market is made only when investment is made at the right price but I fail to understand majority sell in panic at low and same people buy back at higher levels and many talk about resistance and support too much and if u r a investor all these jargon is of no use. http://prabhakar-views.blogspot.com/2006/08/guru-vs-student_27.html “Rake the markets for bargains. Markets make mistakes” – Benjamin Graham I would advise everyone to read this great people of all time in stock market.

NEWS:

Stone India Ltd, supplier of brake systems and train lighting alternators for the railroad industry, on Monday said it has bagged an initial defence freight car up-gradation order from the ministry of defence.(BL)

Bajaj Auto will invest Rs 2,000 crore to set up a Greenfield facility near Pune for manufacturing four-wheeled commercial vehicles.(BS)

Ultratech Ltd has earmarked a capex of Rs 1,424 crore, which will be spent over the next three years.(BL)

The Karnataka government on Monday cleared IT major Tata Consultancy Services' (TCS) proposal for special economic zones (SEZs) at four locations in the state with a combined investment of Rs 1,150 crore.(BS)

Larsen & Toubro Ltd (L&T) has informed the BSE that the members at the annual general meeting (AGM) of the company held on August 25, 2006, have approved the issue of bonus shares in the ratio of 1:1(BL)

Shree Renuka Sugars Ltd has entered into an agreement with an European utility company for sale of about 11,500 Certified Emission Reductions (CERs) from their Munoli Project in Karnataka.(ET)

Sintex Industries Ltd on Monday said it would invest Rs 410 crore in next four years for its expansion plan, which includes increasing the capacity for its plastic and textile divisions- (ET)--Bharati Shipyard Ltd on Monday said it has bagged an order with offshore division of Great Eastern Shipping Co Ltd (GESCO) for manufacture and supply of a jack up drill rig

http://in.groups.yahoo.com/group/prabhakar-views/join join and view files and links it is like a library.

Disclaimer: trade in stock market is high risk& high return and I do not accept any financial and/or legal responsibility arising the use of the information this is no offer to buy/sell jus my views to share.

http://business-standard.com/common/storypage_c.php?leftnm=10&autono=102842 Steel prices stabilise on global trend.

http://news.bbc.co.uk/2/hi/business/5293950.stm BP increases Alaskan oil output

Sensex (11619) SUPPORT-11556-11482-11426 RESISTANCE-11688-11765-11877 Sensex above 11635 should give a big upside but now we should not break 11500 on the downside on the higher side 11930 which has been a major resistance & support in last rally would be one place were sensex would find a major resistance.

8dma=11510 13dma=11410 21dma=11190 34dma=10913 55dma=10631 OPEN=11583 HIGH=11633 LOW=11552 BSE adv: 1431 dec: 1047 -vol-rs.2364crs

Fiis buyer rs.67crs and Mutual funds buyer rs.193crs on Friday, Fiis buyer rs.3893crs in August month and buyer rs.16640Crs in 2006, mutual fund buyer rs.251crs in August month. F&O DATA Fiis sell rs.67crs in nifty future and sell rs.8crs in stock future on 28th August and provisional Fiis sell in cash rs.32crs source NSE website

Day That Ended: LOW volume day with no major activity and late buying made markets close at higher levels Crude $70.50 & FED would pause rate hike could be reasons for the late rally. BSEMETAL-CAPITALGOODS-OIL&GAS were noticeable gainers but very low volume and positive advance decline ratio is not a good sign, if the low volume is due to festival season then it is understandable. International markets U.S markets end higher as oil prices pull back Market also enlivened by mergers and acquisitions, Indian ADRs closed positive, EURO markets closed positive and ASIAN markets has opened on a very positive note.

Outlook for Tuesday: HPCL-BPCL would be the best stock for the day and they can give fast returns of 10-15% returns very soon. BIOCON-GDL-HIMATSEIDE-HINDSANTIARY-AMTEKAUTO-WOCKHARD-TVSMOTORS-PUNJABTRACTOR would be stock which would give good returns in short term. And fall of crude due to many factors would boost many stocks related to it IPCL-HPCL-BPCL-GAIL-RELIANCE-CENTURYENKA-INDORAMASYS-POLYPLEX-XPROINDIA are few stocks many packing-manmadefibre industry stocks there.

http://prabhakar-views.blogspot.com/2006/08/crude-can-crash.html this was about crude.

Mylan take over of Matrix lab would open the floodgates for many more takeovers & tie-up in pharma (VALUE PICK) WOCKHARD-BIOCON-ORCHIDCHEM- CIPLA-RANABXY.

STOCK TECH view: BIOCON this stock was recommended at lower levels it reached rs.403 and corrected now at rs.370-380 one can buy it can cross rs.430 soon so reward in my view looks attractive and long term target can be much higher. WOCKHARD is a clear underperformer in this rally and would soon catch up in my view investor with a longer term view can accumulate the stock.

Counter view: Profit in stock market is made only when investment is made at the right price but I fail to understand majority sell in panic at low and same people buy back at higher levels and many talk about resistance and support too much and if u r a investor all these jargon is of no use. http://prabhakar-views.blogspot.com/2006/08/guru-vs-student_27.html “Rake the markets for bargains. Markets make mistakes” – Benjamin Graham I would advise everyone to read this great people of all time in stock market.

NEWS:

Stone India Ltd, supplier of brake systems and train lighting alternators for the railroad industry, on Monday said it has bagged an initial defence freight car up-gradation order from the ministry of defence.(BL)

Bajaj Auto will invest Rs 2,000 crore to set up a Greenfield facility near Pune for manufacturing four-wheeled commercial vehicles.(BS)

Ultratech Ltd has earmarked a capex of Rs 1,424 crore, which will be spent over the next three years.(BL)

The Karnataka government on Monday cleared IT major Tata Consultancy Services' (TCS) proposal for special economic zones (SEZs) at four locations in the state with a combined investment of Rs 1,150 crore.(BS)

Larsen & Toubro Ltd (L&T) has informed the BSE that the members at the annual general meeting (AGM) of the company held on August 25, 2006, have approved the issue of bonus shares in the ratio of 1:1(BL)

Shree Renuka Sugars Ltd has entered into an agreement with an European utility company for sale of about 11,500 Certified Emission Reductions (CERs) from their Munoli Project in Karnataka.(ET)

Sintex Industries Ltd on Monday said it would invest Rs 410 crore in next four years for its expansion plan, which includes increasing the capacity for its plastic and textile divisions- (ET)--Bharati Shipyard Ltd on Monday said it has bagged an order with offshore division of Great Eastern Shipping Co Ltd (GESCO) for manufacture and supply of a jack up drill rig

http://in.groups.yahoo.com/group/prabhakar-views/join join and view files and links it is like a library.

Disclaimer: trade in stock market is high risk& high return and I do not accept any financial and/or legal responsibility arising the use of the information this is no offer to buy/sell jus my views to share.

http://business-standard.com/common/storypage_c.php?leftnm=10&autono=102842 Steel prices stabilise on global trend.

http://news.bbc.co.uk/2/hi/business/5293950.stm BP increases Alaskan oil output

Sunday, August 27, 2006

GURU vs STUDENT

The first step in identifying an appropriate investment strategy is to take a close look at historical data on asset returns. We can then apply reverse engineering to identify the investment model that has proven the most sustainable and profitable over the long run. Taking George Santayana words, we believe that those who do not study history are doomed to repeat it.

The soundness of equity investing in terms of long-term average performance now validated, we can identify the correct strategy to put in place in order to get a satisfactory performance. When it comes to strategy, everybody wants to buy low and sell high. But how low is low and how high is high? Generally, the market is torn between two camps: Growth and Value. Growth investors believe in buying stocks with above-average earnings growth no matter what the price. Value investors look exclusively for stocks that are trading at a discount to their usual valuation. What we tend to find out over the long term is that growth companies, mostly overpriced, will tend to regress to the norm or lower while undervalued companies will tend to advance to the norm or higher. Let us analyze historical data since, even though we are constantly reminded that past performance is no guarantee for future performance, we haven’t found a better way to identify the winners from the losers.

The teacher Benjamin Graham was a seminal figure on Wall Street and is widely acknowledged to be the father of modern security analysis. As the founder of the value school of investing at Columbia University. Graham influenced such subsequent investment professionals as Warren Buffett, Mario Gabelli, John Neff, Michael Price, Bill Ruane, Al Frank, Charles Brandes and John Bogle. His timeless books, Security Analysis and The Intelligent Investor, are still considered the references for both individual and professional investors. Written only a few years after the devastating stock market crash of 1929, his value investing methods have one objective: to make the investment process as safe as possible.

The teacher Benjamin Graham was a seminal figure on Wall Street and is widely acknowledged to be the father of modern security analysis. As the founder of the value school of investing at Columbia University. Graham influenced such subsequent investment professionals as Warren Buffett, Mario Gabelli, John Neff, Michael Price, Bill Ruane, Al Frank, Charles Brandes and John Bogle. His timeless books, Security Analysis and The Intelligent Investor, are still considered the references for both individual and professional investors. Written only a few years after the devastating stock market crash of 1929, his value investing methods have one objective: to make the investment process as safe as possible.

The student Buffett, the most famous of Graham’s students, believed strongly in Graham's theory that it is wise to look for stocks of companies which are undervalued and will most probably prosper over time. Thus began Buffett’s untraditional approach to portfolio management. After working for his father's investment banking company for the three years after business school, Buffett returned to New York and worked as a security analyst at Graham's company for two years until 1956. In that year, at the age of twenty-five, he started his own investment company, Buffett Partnership, using $5,000 of his own funds and collecting $100,000 from interested friends and family. Since 1965 he has been the CEO of Berkshire Hathaway, a conglomerate that owns simple and understandable businesses with a long history of success. In 2002, company sales were $42,6 billions and earnings $4,2 billions.

The student Buffett, the most famous of Graham’s students, believed strongly in Graham's theory that it is wise to look for stocks of companies which are undervalued and will most probably prosper over time. Thus began Buffett’s untraditional approach to portfolio management. After working for his father's investment banking company for the three years after business school, Buffett returned to New York and worked as a security analyst at Graham's company for two years until 1956. In that year, at the age of twenty-five, he started his own investment company, Buffett Partnership, using $5,000 of his own funds and collecting $100,000 from interested friends and family. Since 1965 he has been the CEO of Berkshire Hathaway, a conglomerate that owns simple and understandable businesses with a long history of success. In 2002, company sales were $42,6 billions and earnings $4,2 billions.

An investor looks for good investments that are reasonably priced, while a speculator “bets” on risky vehicles. An investor holds high-quality stocks for the long term and anticipates gradual price appreciation. But speculators hope for rapid gains, so they can sell quickly and move on to their next gamble. Sometimes they win, and sometimes they lose. If you want to achieve your long-term financial goals, you might want to heed Graham’s advice: Be an investor, not a speculator.

Your financial picture is not exactly like anyone else’s, so you will need to create investment strategies that are tailored to your needs, goals and preferences. You may benefit from working with a financial professional who knows your situation and can recommend appropriate solutions. So, listen to the words of experience - but let your own voice be your true guide.

Benjamin Graham once commented that the biggest trap into which investors fall is the decouple price from value, to stray from the facts and base trading decisions on the action of others. By relying on dubious statistics and market timing scenarios - rather than focusing on companies and their fundamental performances, investors undermine their goals. These mistakes explain why most investors fail to achieve adequate returns over the long run.

“Either you see it or you don’t, and what we see is that patience is a discipline that works beautifully in the stock market” – Warren Buffett

“Most of the money I make is in the third or fourth year I’ve owned something” - Peter Lynch

“Most of the money I make is in the third or fourth year I’ve owned something” - Peter Lynch

“How much is this company worth?” is probably the first reasonable question to ask before investing in a company, yet how many people raise this question? To invest wisely, you need to understand the principles of valuation.

“Rake the markets for bargains. Markets make mistakes” – Benjamin Graham

Buffet’s genius is largely his character – of patience, discipline, and rationality; his talent, of unrivaled independence of mind and the ability to shut out the financial world of Wall Street and the CNBCs of this world. He once wrote that he would no more take an investment banker’s opinion on whether to do a deal than he would ask a barber whether he needed a haircut.

Patience is the prime quality of the value investor as success in the market is linked to the price you pay and the time period you hold on to your shares. Buy a growth stock at an attractive low price with the intention of holding it over the long run and your chances of a strong gain are excellent. But buy the same high quality stock at a high price and your chances of profit are reduced significantly. The basic principle here is that one should not buy a stock unless it has reached the right price.

The soundness of equity investing in terms of long-term average performance now validated, we can identify the correct strategy to put in place in order to get a satisfactory performance. When it comes to strategy, everybody wants to buy low and sell high. But how low is low and how high is high? Generally, the market is torn between two camps: Growth and Value. Growth investors believe in buying stocks with above-average earnings growth no matter what the price. Value investors look exclusively for stocks that are trading at a discount to their usual valuation. What we tend to find out over the long term is that growth companies, mostly overpriced, will tend to regress to the norm or lower while undervalued companies will tend to advance to the norm or higher. Let us analyze historical data since, even though we are constantly reminded that past performance is no guarantee for future performance, we haven’t found a better way to identify the winners from the losers.

The teacher Benjamin Graham was a seminal figure on Wall Street and is widely acknowledged to be the father of modern security analysis. As the founder of the value school of investing at Columbia University. Graham influenced such subsequent investment professionals as Warren Buffett, Mario Gabelli, John Neff, Michael Price, Bill Ruane, Al Frank, Charles Brandes and John Bogle. His timeless books, Security Analysis and The Intelligent Investor, are still considered the references for both individual and professional investors. Written only a few years after the devastating stock market crash of 1929, his value investing methods have one objective: to make the investment process as safe as possible.

The teacher Benjamin Graham was a seminal figure on Wall Street and is widely acknowledged to be the father of modern security analysis. As the founder of the value school of investing at Columbia University. Graham influenced such subsequent investment professionals as Warren Buffett, Mario Gabelli, John Neff, Michael Price, Bill Ruane, Al Frank, Charles Brandes and John Bogle. His timeless books, Security Analysis and The Intelligent Investor, are still considered the references for both individual and professional investors. Written only a few years after the devastating stock market crash of 1929, his value investing methods have one objective: to make the investment process as safe as possible. The student Buffett, the most famous of Graham’s students, believed strongly in Graham's theory that it is wise to look for stocks of companies which are undervalued and will most probably prosper over time. Thus began Buffett’s untraditional approach to portfolio management. After working for his father's investment banking company for the three years after business school, Buffett returned to New York and worked as a security analyst at Graham's company for two years until 1956. In that year, at the age of twenty-five, he started his own investment company, Buffett Partnership, using $5,000 of his own funds and collecting $100,000 from interested friends and family. Since 1965 he has been the CEO of Berkshire Hathaway, a conglomerate that owns simple and understandable businesses with a long history of success. In 2002, company sales were $42,6 billions and earnings $4,2 billions.

The student Buffett, the most famous of Graham’s students, believed strongly in Graham's theory that it is wise to look for stocks of companies which are undervalued and will most probably prosper over time. Thus began Buffett’s untraditional approach to portfolio management. After working for his father's investment banking company for the three years after business school, Buffett returned to New York and worked as a security analyst at Graham's company for two years until 1956. In that year, at the age of twenty-five, he started his own investment company, Buffett Partnership, using $5,000 of his own funds and collecting $100,000 from interested friends and family. Since 1965 he has been the CEO of Berkshire Hathaway, a conglomerate that owns simple and understandable businesses with a long history of success. In 2002, company sales were $42,6 billions and earnings $4,2 billions.An investor looks for good investments that are reasonably priced, while a speculator “bets” on risky vehicles. An investor holds high-quality stocks for the long term and anticipates gradual price appreciation. But speculators hope for rapid gains, so they can sell quickly and move on to their next gamble. Sometimes they win, and sometimes they lose. If you want to achieve your long-term financial goals, you might want to heed Graham’s advice: Be an investor, not a speculator.

Your financial picture is not exactly like anyone else’s, so you will need to create investment strategies that are tailored to your needs, goals and preferences. You may benefit from working with a financial professional who knows your situation and can recommend appropriate solutions. So, listen to the words of experience - but let your own voice be your true guide.

Benjamin Graham once commented that the biggest trap into which investors fall is the decouple price from value, to stray from the facts and base trading decisions on the action of others. By relying on dubious statistics and market timing scenarios - rather than focusing on companies and their fundamental performances, investors undermine their goals. These mistakes explain why most investors fail to achieve adequate returns over the long run.

“Either you see it or you don’t, and what we see is that patience is a discipline that works beautifully in the stock market” – Warren Buffett

“Most of the money I make is in the third or fourth year I’ve owned something” - Peter Lynch

“Most of the money I make is in the third or fourth year I’ve owned something” - Peter Lynch“How much is this company worth?” is probably the first reasonable question to ask before investing in a company, yet how many people raise this question? To invest wisely, you need to understand the principles of valuation.

“Rake the markets for bargains. Markets make mistakes” – Benjamin Graham

Buffet’s genius is largely his character – of patience, discipline, and rationality; his talent, of unrivaled independence of mind and the ability to shut out the financial world of Wall Street and the CNBCs of this world. He once wrote that he would no more take an investment banker’s opinion on whether to do a deal than he would ask a barber whether he needed a haircut.

Patience is the prime quality of the value investor as success in the market is linked to the price you pay and the time period you hold on to your shares. Buy a growth stock at an attractive low price with the intention of holding it over the long run and your chances of a strong gain are excellent. But buy the same high quality stock at a high price and your chances of profit are reduced significantly. The basic principle here is that one should not buy a stock unless it has reached the right price.

Saturday, August 26, 2006

investor VS speculator

WIPRO: Wipro has been consolidating very good and this would be the classis example of how big hand when they buy they never allow the stock to cross certain levels in case of Wipro it is rs.525 above levels but important to note is the lows have been moving higher suggesting that enough volumes are not available and once rs.525 above levels are crossed stock would perform better than index as the stock has gone into the strong hands. Many investor I have seen never like to hold good stock which are not performing for 2-3months and they would be cursing everyone that the stock is not moving up while every stock in markets is zooming but they fail to understand dynamics of stock markets a stocks needs jus few trading days to gain even 50-100% and which are those few days is the biggest ? If everyone can know that all would make money in markets here I would add …“We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.” - Warren Buffett, How do people act greedy? By chasing after “hot” stocks in hopes of ever-higher gains - even if the stock prices are not supported by earnings and other key fundamentals. How do investors express their fear? By trying to “cut their losses” through selling stocks when the price drops - even if the stocks still offer good long-term growth potential. (So art of making money in stock markets differ person to person so when u follow someone one should understand the method he follows and if that suits u r urgency and returns a speculator and a day trader shouldn’t buy a stock because warren buffet is buying or recommending)

WIPRO: Wipro has been consolidating very good and this would be the classis example of how big hand when they buy they never allow the stock to cross certain levels in case of Wipro it is rs.525 above levels but important to note is the lows have been moving higher suggesting that enough volumes are not available and once rs.525 above levels are crossed stock would perform better than index as the stock has gone into the strong hands. Many investor I have seen never like to hold good stock which are not performing for 2-3months and they would be cursing everyone that the stock is not moving up while every stock in markets is zooming but they fail to understand dynamics of stock markets a stocks needs jus few trading days to gain even 50-100% and which are those few days is the biggest ? If everyone can know that all would make money in markets here I would add …“We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.” - Warren Buffett, How do people act greedy? By chasing after “hot” stocks in hopes of ever-higher gains - even if the stock prices are not supported by earnings and other key fundamentals. How do investors express their fear? By trying to “cut their losses” through selling stocks when the price drops - even if the stocks still offer good long-term growth potential. (So art of making money in stock markets differ person to person so when u follow someone one should understand the method he follows and if that suits u r urgency and returns a speculator and a day trader shouldn’t buy a stock because warren buffet is buying or recommending)

Daily Report August 28th Monday

Nifty (3385) SUPPORT-3369-3337-3311 RESISTANCE-3405-3435-3475 Nifty range 3369-3435 markets be more flat due to F&O expiry and any decisive break above 3435 would be very bullish for markets. Heavy Puts-Calls written at 3400 gives a range of 3360-3430 for a closing basis in nifty for the next 2days. TOP 5GAINERS=ZEETELE-SBIN-GAIL-HINDALCO-HINDLEVER TOP5LOSER=REL-BPCL-TATAMOTORS-WIPRO-DRREDDY. P/E=19 p/b=4.58 adv=32 dec=18 NSE adv: 551 dec: 365 -vol-rs.6476crs

Sensex (11572) SUPPORT-11519-11432-11360 RESISTANCE-11648-11714-11830 Sensex has given a positive close in spite of weekend squaring off which is a good sign as intraday movement was jus 93points. Index should move out of this range and give solid gains in the coming week as 3months of correction and consolidation this month has given the highest gain so far and any 300-500 points gain the coming week would be very good sign.

8dma=11489 13dma=11363 21dma=11148 34dma=10885 55dma=10592 OPEN=11589 HIGH=11635 LOW=11542 BSE adv: 1432 dec: 1056 -vol-rs.3194crs

Fiis buyer rs.67crs and Mutual funds buyer rs.58crs on Thursday, Fiis buyer rs.3826crs in August month and buyer rs.16572Crs in 2006, mutual fund buyer rs.57crs in August month. F&O DATA Fiis buy rs.138crs in nifty future and sell rs.231crs in stock future on 25th August and provisional Fiis sell in cash rs.59crs source NSE website

Day That Ended: Markets gaped up to close it back weekend consideration and F&O expiry where few factors which made traders to unwind position and with no major movement, good volumes and positive advance to decline ratio. METALS-CD-BANKEX-FMCG where few sector index which has moved up and BSE METAL is looking like a breakout. International markets U.S markets mixed NASDAQ closed positive while DOW in negative but both marginally Indian ADRs flat to negative EURO markets flat to positive Crude $72.51.

Outlook for Monday: Bullish view and more towards stocks which haven’t preformed BEML-BHARTISHIPYARD-WIPRO -SAIL-BIOCON-NELCO-HPCL-BPCL-WOCKHARD-ONGC. FED Chief failed to give any indication of how interest rate regime would be going forward which has made many to think one more pause would be possible but any cut in rate would surprise markets on the upside, And with Hurricane turning into a storm Crude prices would ease

STOCK TECH view: Bhartishipyard: Buy rs.300-320 target rs.405-425 which is solid 25% returns so it is worth investment even if takes 5-6months but in my view this would soon be a flier soon jus have a look at graph http://prabhakar-views.blogspot.com Sail is looking good in graph above rs.80 close for 2-3days would give 15-20% at a very fast time period.

Counter view: WIPRO: Wipro has been consolidating very good and this would be the classis example of how big hand when they buy they never allow the stock to cross certain levels in case of Wipro it is rs.525 above levels but important to note is the lows have been moving higher suggesting that enough volumes are not available and once rs.525 above levels are crossed stock would perform better than index as the stock has gone into the strong hands. Many investor I have seen never like to hold good stock which are not performing for 2-3months and they would be cursing everyone that the stock is not moving up while every stock in markets is zooming but they fail to understand dynamics of stock markets a stocks needs jus few trading days to gain even 50-100% and which are those few days is the biggest ? If everyone can know that all would make money in markets here I would add …“We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.” - Warren Buffett, How do people act greedy? By chasing after “hot” stocks in hopes of ever-higher gains - even if the stock prices are not supported by earnings and other key fundamentals. How do investors express their fear? By trying to “cut their losses” through selling stocks when the price drops - even if the stocks still offer good long-term growth potential. (So art of making money in stock markets differ person to person so when u follow someone one should understand the method he follows and if that suits u r urgency and returns a speculator and a day trader shouldn’t buy a stock because warren buffet is buying or recommending)

NEWS:

Corporate news:

(Reuters) - Hindustan Motors Ltd. will invest 1 billion rupees in five years to expand and diversify its car plant in Uttarpara, near Kolkata, a top official said.

(DNA)- Engineering giant Larsen and Toubro is confident of bagging the construction rights of at least one of the two airports which were handed over to private parties recently, chairman and managing director A M Naik said on Friday.

(Market Watch)- India's HT Media says open to Wall Street Journal taking stake, If the (government) rules allow, we have no problems (with the Wall Street Journal buying a stake)," Seema Chandra, chief financial officer of HT Media told Dow Jones Newswires. "It only cements the relationship." Earlier Friday, HT Media and the Wall Street Journal announced an agreement under which the Indian company's soon-to-be-launched business daily and its web site will publish Wall Street Journal branded pages.

(BS)- Voltas and Netherlands-based Besseling-Group are forming a strategic partnership to deliver turnkey solutions for storage of horticulture produce using controlled atmosphere (CA)/ ultra-low-oxygen (ULO) technology.

(BS)- FMCG major Emami is planning to promote Boro Plus as a global brand in order to become an Indian FMCG transnational in five years.

http://in.groups.yahoo.com/group/prabhakar-views/join join and view files and links it is like a library.

Disclaimer: trade in stock market is high risk& high return and I do not accept any financial and/or legal responsibility arising the use of the information this is no offer to buy/sell jus my views to share.

http://www.newstarget.com/003228.html The unauthorized history of Coca-Cola

http://www.hindustantimes.com/news/181_1777141,000600010001.htm cable operators to maintain a 24X7 complaint center.

http://article.wn.com/view/2006/08/25/Investors_advised_to_bet_on_India_China Investors advised to bet on India & China

http://www.chinadaily.com.cn/world/2006-08/26/content_674955.htm Tropical Storm hits Caribbean

Sensex (11572) SUPPORT-11519-11432-11360 RESISTANCE-11648-11714-11830 Sensex has given a positive close in spite of weekend squaring off which is a good sign as intraday movement was jus 93points. Index should move out of this range and give solid gains in the coming week as 3months of correction and consolidation this month has given the highest gain so far and any 300-500 points gain the coming week would be very good sign.

8dma=11489 13dma=11363 21dma=11148 34dma=10885 55dma=10592 OPEN=11589 HIGH=11635 LOW=11542 BSE adv: 1432 dec: 1056 -vol-rs.3194crs

Fiis buyer rs.67crs and Mutual funds buyer rs.58crs on Thursday, Fiis buyer rs.3826crs in August month and buyer rs.16572Crs in 2006, mutual fund buyer rs.57crs in August month. F&O DATA Fiis buy rs.138crs in nifty future and sell rs.231crs in stock future on 25th August and provisional Fiis sell in cash rs.59crs source NSE website

Day That Ended: Markets gaped up to close it back weekend consideration and F&O expiry where few factors which made traders to unwind position and with no major movement, good volumes and positive advance to decline ratio. METALS-CD-BANKEX-FMCG where few sector index which has moved up and BSE METAL is looking like a breakout. International markets U.S markets mixed NASDAQ closed positive while DOW in negative but both marginally Indian ADRs flat to negative EURO markets flat to positive Crude $72.51.

Outlook for Monday: Bullish view and more towards stocks which haven’t preformed BEML-BHARTISHIPYARD-WIPRO -SAIL-BIOCON-NELCO-HPCL-BPCL-WOCKHARD-ONGC. FED Chief failed to give any indication of how interest rate regime would be going forward which has made many to think one more pause would be possible but any cut in rate would surprise markets on the upside, And with Hurricane turning into a storm Crude prices would ease

STOCK TECH view: Bhartishipyard: Buy rs.300-320 target rs.405-425 which is solid 25% returns so it is worth investment even if takes 5-6months but in my view this would soon be a flier soon jus have a look at graph http://prabhakar-views.blogspot.com Sail is looking good in graph above rs.80 close for 2-3days would give 15-20% at a very fast time period.

Counter view: WIPRO: Wipro has been consolidating very good and this would be the classis example of how big hand when they buy they never allow the stock to cross certain levels in case of Wipro it is rs.525 above levels but important to note is the lows have been moving higher suggesting that enough volumes are not available and once rs.525 above levels are crossed stock would perform better than index as the stock has gone into the strong hands. Many investor I have seen never like to hold good stock which are not performing for 2-3months and they would be cursing everyone that the stock is not moving up while every stock in markets is zooming but they fail to understand dynamics of stock markets a stocks needs jus few trading days to gain even 50-100% and which are those few days is the biggest ? If everyone can know that all would make money in markets here I would add …“We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.” - Warren Buffett, How do people act greedy? By chasing after “hot” stocks in hopes of ever-higher gains - even if the stock prices are not supported by earnings and other key fundamentals. How do investors express their fear? By trying to “cut their losses” through selling stocks when the price drops - even if the stocks still offer good long-term growth potential. (So art of making money in stock markets differ person to person so when u follow someone one should understand the method he follows and if that suits u r urgency and returns a speculator and a day trader shouldn’t buy a stock because warren buffet is buying or recommending)

NEWS:

Corporate news:

(Reuters) - Hindustan Motors Ltd. will invest 1 billion rupees in five years to expand and diversify its car plant in Uttarpara, near Kolkata, a top official said.

(DNA)- Engineering giant Larsen and Toubro is confident of bagging the construction rights of at least one of the two airports which were handed over to private parties recently, chairman and managing director A M Naik said on Friday.

(Market Watch)- India's HT Media says open to Wall Street Journal taking stake, If the (government) rules allow, we have no problems (with the Wall Street Journal buying a stake)," Seema Chandra, chief financial officer of HT Media told Dow Jones Newswires. "It only cements the relationship." Earlier Friday, HT Media and the Wall Street Journal announced an agreement under which the Indian company's soon-to-be-launched business daily and its web site will publish Wall Street Journal branded pages.

(BS)- Voltas and Netherlands-based Besseling-Group are forming a strategic partnership to deliver turnkey solutions for storage of horticulture produce using controlled atmosphere (CA)/ ultra-low-oxygen (ULO) technology.

(BS)- FMCG major Emami is planning to promote Boro Plus as a global brand in order to become an Indian FMCG transnational in five years.

http://in.groups.yahoo.com/group/prabhakar-views/join join and view files and links it is like a library.

Disclaimer: trade in stock market is high risk& high return and I do not accept any financial and/or legal responsibility arising the use of the information this is no offer to buy/sell jus my views to share.

http://www.newstarget.com/003228.html The unauthorized history of Coca-Cola

http://www.hindustantimes.com/news/181_1777141,000600010001.htm cable operators to maintain a 24X7 complaint center.

http://article.wn.com/view/2006/08/25/Investors_advised_to_bet_on_India_China Investors advised to bet on India & China

http://www.chinadaily.com.cn/world/2006-08/26/content_674955.htm Tropical Storm hits Caribbean

BHARTI SHIPYARD

Friday, August 25, 2006

PUNJLLOYD

Daily Report August 25th Friday

Nifty (3370) SUPPORT-3354-3337-3310 RESISTANCE-3398-3429-3475 Nifty range 3366-3450 now one should have more aggressive stop loss and it has to be placed at 3337 and we need to break above 3400 and close. Nifty is showing signs of reaching target of 3800 in 2months but each and every day would be a struggle between bulls & bears till a new high is reached so there is no place for complacent. TOP 5GAINERS=IPCL-PNB-RELIANCE-GAIL-HINDALCO TOP5LOSER=ABB-ONGC-REL-SAIL-BHEL. P/E=18.91 p/b=4.56 adv=42 dec=8 NSE adv: 490 dec: 419 -vol-rs.6747crs

Sensex (11531) SUPPORT-11447-11380-11305 RESISTANCE-11598-11688-10772 Sensex has done with its correction now it should target higher levels markets would be very bullish till 11447 is not cut on the lower side and Thursday close gives a confirmation for a gap up open and we could possibly see one more day of big gains. TECH=WIPRO+INFY+SATYMCOMP+TCS & RELIANCE would possibly do the magic.

8dma=10457 13dma=11305 21dma=11103 34dma=10854 55dma=10560 OPEN=11367 HIGH=11566 LOW=11297 BSE adv: 1346 dec: 1121 -vol-rs.3164crs

Fiis seller rs.9crs and Mutual funds seller rs.28crs on Wednesday, Fiis buyer rs.3810crs in August month and buyer rs.16557Crs in 2006, mutual fund buyer rs.226crs in August month. F&O DATA Fiis sell rs.535crs in nifty future and sell rs.398crs in stock future on 24th August and provisional Fiis sell in cash rs.24crs source NSE website

Day That Ended: Market opened week and gained strength as the day progressed and short covering towards the end made Nifty fut to close at premium and OIL-METALS-AUTO where the sectors which gained. The rise has been with rise in volumes with positive advance to decline ratio and no major negative news in markets for now that is major positive news. Iran response and reaction would take time and it would cool off oil markets and with France sending more troops Lebanon there is temporary peace in place now in Middle East Crude $72.82 moved up due to Tropical Storm Ernesto. International markets U.S closed positive Indian ADRs mixed with more positive bias EURO market closed big positive and ASIAN markets has opened on a positive note.

Outlook for Friday: Markets to be positive with TECH stocks which would make a big difference soon BSEIT & BSETECK is giving a impression that they would give nearly 30% returns soon. RELIANCE-IPCL have given a good breakout and soon all time high would be breached, markets staying at higher levels would force short to push the markets up and TITAN-SBIN-BHEL- TECH & AUTO SECTOR stocks would be in limelight with Metals.

http://in.groups.yahoo.com/group/prabhakar-views/files/daily%20update here delivery volumes is loaded and HEROHONDA has 70% delivery and lot of info given in file & link.

STOCK TECH view: WIPRO breakout above rs.525 and would target rs.585-600 soon but one can buy in before a breakout also and the stock is showing lot of strength. PUNJLLOYD stock has a strong support at rs.730 and would give good solid reward of 15-20% and risk should be below rs.730.

NEWS:

The global emergence and resurgence of epidemics such as AIDS, tuberculosis and malaria is expected to translate into a $2 billion opportunity for Indian generic players, particularly early movers such as Cipla, Aurobindo and Lupin.(TOI)

Punj Lloyd has signed a 49:51 joint venture agreement with Germany-based KAEFER GmbH, a world leader in insulation business. (BS)

Larsen & Toubro Ltd along with its consortium partner, Denmark's Haldor Topsoe AS, has bagged an order worth over Rs 698 crore ($150 million) from Saudi Formaldehyde Chemical Company Ltd, for setting up high technology methanol and carbon monoxide plants.(ET)

Economic ministers of the Association of Southeast Asian Nations (ASEAN) and India Thursday reaffirmed their will to move forward their negotiations on trade in goods.

BP, the UK oil giant, was forced to further reduce production from its Alaskan oil field on Wednesday, after it had to shut down a gathering centre due to a mechanical failure in a compressor. That cut daily production from 200,000 barrels to 110,000 barrels, which is likely to have repercussions in the tightly-balanced oil market, which was rattled when BP last cut production from the field. (FT)

Tata Group plans to invest Rs 1.20 trillion ($25.8 billion) in the next three to five years in telecommunications, steel, chemicals, power and other industries, a Group official said on Thursday.(FE)

http://in.groups.yahoo.com/group/prabhakar-views/join

Disclaimer: trade in stock market is high risk& high return and I do not accept any financial and/or legal responsibility arising the use of the information this is no offer to buy/sell jus my views to share.

http://www.kommersant.com/page.asp?idr=527&id=699853 Tehran's response to the proposals of the Six

http://www.newratings.com/analyst_news/article_1352615.html Tata Group acquires 30% stake in Glaceau

http://news.xinhuanet.com/english/2006-08/24/content_5002909.htm?rss=1 India to move forward FTA negotiations

http://economictimes.indiatimes.com/articleshow/1923729.cms

http://abcnews.go.com/WNT/story?id=2349435&page=1 White House Softens Iran Nuclear Response

http://www.bloomberg.com/apps/news?pid=20602099&sid=a7cfnmcsRYYA&refer=energy Crude Oil Rises as Storm Forms

http://timesofindia.indiatimes.com/articleshow/1924268.cms Pharma firms can reap $2b

Sensex (11531) SUPPORT-11447-11380-11305 RESISTANCE-11598-11688-10772 Sensex has done with its correction now it should target higher levels markets would be very bullish till 11447 is not cut on the lower side and Thursday close gives a confirmation for a gap up open and we could possibly see one more day of big gains. TECH=WIPRO+INFY+SATYMCOMP+TCS & RELIANCE would possibly do the magic.

8dma=10457 13dma=11305 21dma=11103 34dma=10854 55dma=10560 OPEN=11367 HIGH=11566 LOW=11297 BSE adv: 1346 dec: 1121 -vol-rs.3164crs

Fiis seller rs.9crs and Mutual funds seller rs.28crs on Wednesday, Fiis buyer rs.3810crs in August month and buyer rs.16557Crs in 2006, mutual fund buyer rs.226crs in August month. F&O DATA Fiis sell rs.535crs in nifty future and sell rs.398crs in stock future on 24th August and provisional Fiis sell in cash rs.24crs source NSE website

Day That Ended: Market opened week and gained strength as the day progressed and short covering towards the end made Nifty fut to close at premium and OIL-METALS-AUTO where the sectors which gained. The rise has been with rise in volumes with positive advance to decline ratio and no major negative news in markets for now that is major positive news. Iran response and reaction would take time and it would cool off oil markets and with France sending more troops Lebanon there is temporary peace in place now in Middle East Crude $72.82 moved up due to Tropical Storm Ernesto. International markets U.S closed positive Indian ADRs mixed with more positive bias EURO market closed big positive and ASIAN markets has opened on a positive note.

Outlook for Friday: Markets to be positive with TECH stocks which would make a big difference soon BSEIT & BSETECK is giving a impression that they would give nearly 30% returns soon. RELIANCE-IPCL have given a good breakout and soon all time high would be breached, markets staying at higher levels would force short to push the markets up and TITAN-SBIN-BHEL- TECH & AUTO SECTOR stocks would be in limelight with Metals.

http://in.groups.yahoo.com/group/prabhakar-views/files/daily%20update here delivery volumes is loaded and HEROHONDA has 70% delivery and lot of info given in file & link.

STOCK TECH view: WIPRO breakout above rs.525 and would target rs.585-600 soon but one can buy in before a breakout also and the stock is showing lot of strength. PUNJLLOYD stock has a strong support at rs.730 and would give good solid reward of 15-20% and risk should be below rs.730.

NEWS:

The global emergence and resurgence of epidemics such as AIDS, tuberculosis and malaria is expected to translate into a $2 billion opportunity for Indian generic players, particularly early movers such as Cipla, Aurobindo and Lupin.(TOI)

Punj Lloyd has signed a 49:51 joint venture agreement with Germany-based KAEFER GmbH, a world leader in insulation business. (BS)

Larsen & Toubro Ltd along with its consortium partner, Denmark's Haldor Topsoe AS, has bagged an order worth over Rs 698 crore ($150 million) from Saudi Formaldehyde Chemical Company Ltd, for setting up high technology methanol and carbon monoxide plants.(ET)

Economic ministers of the Association of Southeast Asian Nations (ASEAN) and India Thursday reaffirmed their will to move forward their negotiations on trade in goods.

BP, the UK oil giant, was forced to further reduce production from its Alaskan oil field on Wednesday, after it had to shut down a gathering centre due to a mechanical failure in a compressor. That cut daily production from 200,000 barrels to 110,000 barrels, which is likely to have repercussions in the tightly-balanced oil market, which was rattled when BP last cut production from the field. (FT)

Tata Group plans to invest Rs 1.20 trillion ($25.8 billion) in the next three to five years in telecommunications, steel, chemicals, power and other industries, a Group official said on Thursday.(FE)

http://in.groups.yahoo.com/group/prabhakar-views/join

Disclaimer: trade in stock market is high risk& high return and I do not accept any financial and/or legal responsibility arising the use of the information this is no offer to buy/sell jus my views to share.

http://www.kommersant.com/page.asp?idr=527&id=699853 Tehran's response to the proposals of the Six

http://www.newratings.com/analyst_news/article_1352615.html Tata Group acquires 30% stake in Glaceau

http://news.xinhuanet.com/english/2006-08/24/content_5002909.htm?rss=1 India to move forward FTA negotiations

http://economictimes.indiatimes.com/articleshow/1923729.cms

http://abcnews.go.com/WNT/story?id=2349435&page=1 White House Softens Iran Nuclear Response

http://www.bloomberg.com/apps/news?pid=20602099&sid=a7cfnmcsRYYA&refer=energy Crude Oil Rises as Storm Forms

http://timesofindia.indiatimes.com/articleshow/1924268.cms Pharma firms can reap $2b

Thursday, August 24, 2006

Daily Report August 24th Thursday

Nifty (3335) SUPPORT-3318-3295-3272 RESISTANCE-3361-3385-3425 Nifty range 3310-3364 we would see a remarkable recovery in markets by close and a small resistance would be there near 3361-3385 so any close above that by Friday would do well for markets. 3day correction would be healthy and any bounce back would be fast 3398-3271 fall in 3days recovery will be also very fast so guard u r position if u get on the wrong side. TOP 5GAINERS=VSNL-SIEMENS-SUZLON-SATYAMCOMP-GAIL TOP5LOSER=M&M-JETAIRWAYS-HDFC-BAJAJAUTO-HINDPETRO. P/E=18.71 p/b=4.52 adv=12 dec=37 NSE adv:275 dec:640 -vol-rs.5970crs

Sensex (11406) SUPPORT-11340-11264-11194 RESISTANCE-11509-11598-10710 Sensex is facing a very strong support at 11375 and it has not been able to break that if markets are able to close the gap we would have a strong pull back. But in case markets creates a downside gap and doesn’t close within the day it would be advisable to exit markets.

8dma=10414 13dma=11254 21dma=11050 34dma=10831 55dma=10520 OPEN=11579 HIGH=11579 LOW=11374 BSE adv:893 dec:1629 -vol-rs.2997crs

Fiis seller rs.9crs and Mutual funds seller rs.28crs on Tuesday, Fiis buyer rs.3810crs in August month and buyer rs.16557Crs in 2006, mutual fund buyer rs.226crs in August month. F&O DATA Fiis sell rs.353crs in nifty future and sell rs.162crs in stock future on 23rd August and provisional Fiis sell in cash rs.32crs source NSE website

Day That Ended: Markets opened weak and closed even weaker REALESTATE stocks faced good selling pressure as many news pointed to slowing demand for housing in India and in U.S too. PAPER stocks where seen to attract good buying along with TEXTILES, while many PHARMA stocks corrected. Declines where more than advances and volumes lower many cash stocks saw selling pressure. International markets U.S markets where down after data which showed slowing housing demand and general slowdown in economy EURO markets closed weak ASIAN markets has opened weak Crude $71.79.

Outlook for Thursday: Markets to open weak and panic would be good chance to buy, markets have many positive and negative factors so there has been major shift in the sector preference so that is where investor should understand slowdown in housing demand, falling Crude, rising paper prices, strong Yuan which would boost Indian exports, and possibility of pause or even a cut in U.S interest rate are the factors in front of us. PAPER-TEXTILES-OIL would be sector to watch, BILT-TNPL-MNM-ALOKTEX-BHARTISHIRYARD-BEML-FDC-GDL-WOCKHARD-WIPRO-RAYMOND-RANBAXY-BIOCON-TVSMOT would be few good pick for 3-4 months for a average returns of 15-20% some times it can be even more but use the ultimate panic in markets and stocks to enter them.

NEWS:

Corporate news:

Tata Tea buys 30% in Glaceau for $677mn In the largest ever acquisition by an Indian firm, The Tata Group today announced it had acquired a 30% stake in Energy Brands Inc, USA, also known as Glacéau, a specialty mineral water and energy drink company.(BS)

HCL Infosystems celebrated its 30th year posting a 47% growth in consolidated revenue to Rs 11, 455 crore for the year ended June 30, 2006 as against the corresponding previous period's figure of Rs 7787.2 crore. (BS)

Pune-based auto components manufacturer, Bharat Forge is setting up a special economic zone (SEZ) near Pune, on land spread across 5,000 acres at an estimated investment of around Rs 20,000-25,000 crore.(BL)

Dishman Pharmaceuticals and Chemicals Ltd on Wednesday said it has acquired Swiss research based company Cabbogen Amcis AG from Solutia Europe (SESA) for over Rs 349.30 crore ($75 million).(BL)

The US Food and Drug Administration have approved Glenmark Pharmaceuticals Ltd.'s epilepsy drug gabapentin, the regulator's Web site showed on Wednesday.(ET)

International news:

Sales of previously owned U.S. homes fell in July to the lowest in more than two years, a slowdown that may lead the Federal Reserve to keep interest rates steady for a second month.(Bloomberg)

http://in.groups.yahoo.com/group/prabhakar-views/join join and view files and links it is like a library.

Disclaimer: trade in stock market is high risk& high return and I do not accept any financial and/or legal responsibility arising the use of the information this is no offer to buy/sell jus my views to share.

http://www.ft.com/cms/s/609ff4ea-32ca-11db-87ac-0000779e2340,_i_rssPage=9ff9d7a4-506d-11da-bbd7-0000779e2340.html Oil markets face continued imbalances

http://www.bloomberg.com/apps/news?pid=20601087&sid=aftfQZiZlOyg&refer=worldwide_news Japanese Stocks Drop on Concern U.S. Economic Growth Is Slowing

http://www.bloomberg.com/apps/news?pid=20601087&sid=aSfc6b6H8pd4&refer=worldwide_news U.S., France Say Iran Falls Short on Nuclear Bargain

Sensex (11406) SUPPORT-11340-11264-11194 RESISTANCE-11509-11598-10710 Sensex is facing a very strong support at 11375 and it has not been able to break that if markets are able to close the gap we would have a strong pull back. But in case markets creates a downside gap and doesn’t close within the day it would be advisable to exit markets.

8dma=10414 13dma=11254 21dma=11050 34dma=10831 55dma=10520 OPEN=11579 HIGH=11579 LOW=11374 BSE adv:893 dec:1629 -vol-rs.2997crs

Fiis seller rs.9crs and Mutual funds seller rs.28crs on Tuesday, Fiis buyer rs.3810crs in August month and buyer rs.16557Crs in 2006, mutual fund buyer rs.226crs in August month. F&O DATA Fiis sell rs.353crs in nifty future and sell rs.162crs in stock future on 23rd August and provisional Fiis sell in cash rs.32crs source NSE website

Day That Ended: Markets opened weak and closed even weaker REALESTATE stocks faced good selling pressure as many news pointed to slowing demand for housing in India and in U.S too. PAPER stocks where seen to attract good buying along with TEXTILES, while many PHARMA stocks corrected. Declines where more than advances and volumes lower many cash stocks saw selling pressure. International markets U.S markets where down after data which showed slowing housing demand and general slowdown in economy EURO markets closed weak ASIAN markets has opened weak Crude $71.79.

Outlook for Thursday: Markets to open weak and panic would be good chance to buy, markets have many positive and negative factors so there has been major shift in the sector preference so that is where investor should understand slowdown in housing demand, falling Crude, rising paper prices, strong Yuan which would boost Indian exports, and possibility of pause or even a cut in U.S interest rate are the factors in front of us. PAPER-TEXTILES-OIL would be sector to watch, BILT-TNPL-MNM-ALOKTEX-BHARTISHIRYARD-BEML-FDC-GDL-WOCKHARD-WIPRO-RAYMOND-RANBAXY-BIOCON-TVSMOT would be few good pick for 3-4 months for a average returns of 15-20% some times it can be even more but use the ultimate panic in markets and stocks to enter them.

NEWS:

Corporate news:

Tata Tea buys 30% in Glaceau for $677mn In the largest ever acquisition by an Indian firm, The Tata Group today announced it had acquired a 30% stake in Energy Brands Inc, USA, also known as Glacéau, a specialty mineral water and energy drink company.(BS)

HCL Infosystems celebrated its 30th year posting a 47% growth in consolidated revenue to Rs 11, 455 crore for the year ended June 30, 2006 as against the corresponding previous period's figure of Rs 7787.2 crore. (BS)

Pune-based auto components manufacturer, Bharat Forge is setting up a special economic zone (SEZ) near Pune, on land spread across 5,000 acres at an estimated investment of around Rs 20,000-25,000 crore.(BL)

Dishman Pharmaceuticals and Chemicals Ltd on Wednesday said it has acquired Swiss research based company Cabbogen Amcis AG from Solutia Europe (SESA) for over Rs 349.30 crore ($75 million).(BL)

The US Food and Drug Administration have approved Glenmark Pharmaceuticals Ltd.'s epilepsy drug gabapentin, the regulator's Web site showed on Wednesday.(ET)

International news:

Sales of previously owned U.S. homes fell in July to the lowest in more than two years, a slowdown that may lead the Federal Reserve to keep interest rates steady for a second month.(Bloomberg)

http://in.groups.yahoo.com/group/prabhakar-views/join join and view files and links it is like a library.

Disclaimer: trade in stock market is high risk& high return and I do not accept any financial and/or legal responsibility arising the use of the information this is no offer to buy/sell jus my views to share.

http://www.ft.com/cms/s/609ff4ea-32ca-11db-87ac-0000779e2340,_i_rssPage=9ff9d7a4-506d-11da-bbd7-0000779e2340.html Oil markets face continued imbalances

http://www.bloomberg.com/apps/news?pid=20601087&sid=aftfQZiZlOyg&refer=worldwide_news Japanese Stocks Drop on Concern U.S. Economic Growth Is Slowing

http://www.bloomberg.com/apps/news?pid=20601087&sid=aSfc6b6H8pd4&refer=worldwide_news U.S., France Say Iran Falls Short on Nuclear Bargain

Wednesday, August 23, 2006

property slump

Mumbai: It seems the rising interest rates and high property prices are all set to spoil the party in the real estate sector.

Mumbai: It seems the rising interest rates and high property prices are all set to spoil the party in the real estate sector.For the first time in nearly five years, bankers are complaining of a drop in the volume of home loan applications.

Sources told CNN-IBN that enquiries and applications for home loans have seen a decline of 10 to 15 per cent in the past two months.

Bankers says the 2 per cent rise in interest rates on home loans in the past one year and the exponential growth in property prices seem to have led to a fall in home buying.

Market leader ICICI bank says it is witnessing a 10-15 per cent fall in the volume of home loan applications. Sources at rival SBI also say that it may be difficult to achieve the second quarter home loan targets.