The soundness of equity investing in terms of long-term average performance now validated, we can identify the correct strategy to put in place in order to get a satisfactory performance. When it comes to strategy, everybody wants to buy low and sell high. But how low is low and how high is high? Generally, the market is torn between two camps: Growth and Value. Growth investors believe in buying stocks with above-average earnings growth no matter what the price. Value investors look exclusively for stocks that are trading at a discount to their usual valuation. What we tend to find out over the long term is that growth companies, mostly overpriced, will tend to regress to the norm or lower while undervalued companies will tend to advance to the norm or higher. Let us analyze historical data since, even though we are constantly reminded that past performance is no guarantee for future performance, we haven’t found a better way to identify the winners from the losers.

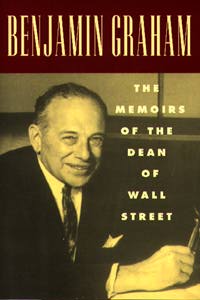

The teacher Benjamin Graham was a seminal figure on Wall Street and is widely acknowledged to be the father of modern security analysis. As the founder of the value school of investing at Columbia University. Graham influenced such subsequent investment professionals as Warren Buffett, Mario Gabelli, John Neff, Michael Price, Bill Ruane, Al Frank, Charles Brandes and John Bogle. His timeless books, Security Analysis and The Intelligent Investor, are still considered the references for both individual and professional investors. Written only a few years after the devastating stock market crash of 1929, his value investing methods have one objective: to make the investment process as safe as possible.

The teacher Benjamin Graham was a seminal figure on Wall Street and is widely acknowledged to be the father of modern security analysis. As the founder of the value school of investing at Columbia University. Graham influenced such subsequent investment professionals as Warren Buffett, Mario Gabelli, John Neff, Michael Price, Bill Ruane, Al Frank, Charles Brandes and John Bogle. His timeless books, Security Analysis and The Intelligent Investor, are still considered the references for both individual and professional investors. Written only a few years after the devastating stock market crash of 1929, his value investing methods have one objective: to make the investment process as safe as possible. The student Buffett, the most famous of Graham’s students, believed strongly in Graham's theory that it is wise to look for stocks of companies which are undervalued and will most probably prosper over time. Thus began Buffett’s untraditional approach to portfolio management. After working for his father's investment banking company for the three years after business school, Buffett returned to New York and worked as a security analyst at Graham's company for two years until 1956. In that year, at the age of twenty-five, he started his own investment company, Buffett Partnership, using $5,000 of his own funds and collecting $100,000 from interested friends and family. Since 1965 he has been the CEO of Berkshire Hathaway, a conglomerate that owns simple and understandable businesses with a long history of success. In 2002, company sales were $42,6 billions and earnings $4,2 billions.

The student Buffett, the most famous of Graham’s students, believed strongly in Graham's theory that it is wise to look for stocks of companies which are undervalued and will most probably prosper over time. Thus began Buffett’s untraditional approach to portfolio management. After working for his father's investment banking company for the three years after business school, Buffett returned to New York and worked as a security analyst at Graham's company for two years until 1956. In that year, at the age of twenty-five, he started his own investment company, Buffett Partnership, using $5,000 of his own funds and collecting $100,000 from interested friends and family. Since 1965 he has been the CEO of Berkshire Hathaway, a conglomerate that owns simple and understandable businesses with a long history of success. In 2002, company sales were $42,6 billions and earnings $4,2 billions.An investor looks for good investments that are reasonably priced, while a speculator “bets” on risky vehicles. An investor holds high-quality stocks for the long term and anticipates gradual price appreciation. But speculators hope for rapid gains, so they can sell quickly and move on to their next gamble. Sometimes they win, and sometimes they lose. If you want to achieve your long-term financial goals, you might want to heed Graham’s advice: Be an investor, not a speculator.

Your financial picture is not exactly like anyone else’s, so you will need to create investment strategies that are tailored to your needs, goals and preferences. You may benefit from working with a financial professional who knows your situation and can recommend appropriate solutions. So, listen to the words of experience - but let your own voice be your true guide.

Benjamin Graham once commented that the biggest trap into which investors fall is the decouple price from value, to stray from the facts and base trading decisions on the action of others. By relying on dubious statistics and market timing scenarios - rather than focusing on companies and their fundamental performances, investors undermine their goals. These mistakes explain why most investors fail to achieve adequate returns over the long run.

“Either you see it or you don’t, and what we see is that patience is a discipline that works beautifully in the stock market” – Warren Buffett

“Most of the money I make is in the third or fourth year I’ve owned something” - Peter Lynch

“Most of the money I make is in the third or fourth year I’ve owned something” - Peter Lynch“How much is this company worth?” is probably the first reasonable question to ask before investing in a company, yet how many people raise this question? To invest wisely, you need to understand the principles of valuation.

“Rake the markets for bargains. Markets make mistakes” – Benjamin Graham

Buffet’s genius is largely his character – of patience, discipline, and rationality; his talent, of unrivaled independence of mind and the ability to shut out the financial world of Wall Street and the CNBCs of this world. He once wrote that he would no more take an investment banker’s opinion on whether to do a deal than he would ask a barber whether he needed a haircut.

Patience is the prime quality of the value investor as success in the market is linked to the price you pay and the time period you hold on to your shares. Buy a growth stock at an attractive low price with the intention of holding it over the long run and your chances of a strong gain are excellent. But buy the same high quality stock at a high price and your chances of profit are reduced significantly. The basic principle here is that one should not buy a stock unless it has reached the right price.

No comments:

Post a Comment